Page 130 - DCAC May 2023 Files

P. 130

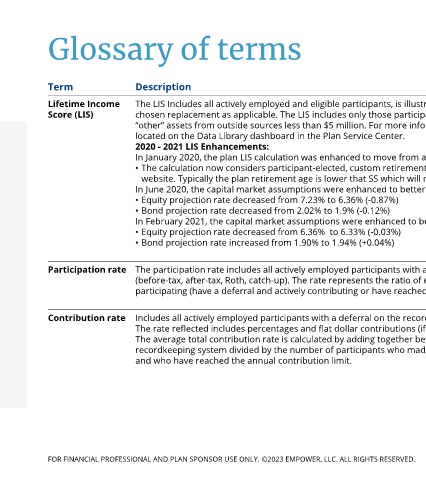

Glossary of terms

Term Description

Lifetime Income The LIS Includes all actively employed and eligible participants, is illustrated as a median value and assumes a retirement income replacement of 75% or a plan

Score (LIS) chosen replacement as applicable. The LIS includes only those participants for which we have a valid annual salary of at least $10,000, date of birth and have

“other” assets from outside sources less than $5 million. For more information please see the Lifetime Income Score Important Information and Disclosure

located on the Data Library dashboard in the Plan Service Center.

2020 - 2021 LIS Enhancements:

In January 2020, the plan LIS calculation was enhanced to move from a generic Social Security retirement age to the plan-specific retirement age.

• The calculation now considers participant-elected, custom retirement ages and the plan retirement age for all participants engaged with the participant

website. Typically the plan retirement age is lower that SS which will result in a lower LIS.

In June 2020, the capital market assumptions were enhanced to better align with market conditions:

• Equity projection rate decreased from 7.23% to 6.36% (-0.87%)

• Bond projection rate decreased from 2.02% to 1.9% (-0.12%)

In February 2021, the capital market assumptions were enhanced to better align with market conditions:

• Equity projection rate decreased from 6.36% to 6.33% (-0.03%)

• Bond projection rate increased from 1.90% to 1.94% (+0.04%)

Participation rate The participation rate includes all actively employed participants with a deferral on the recordkeeping system and includes an election as a percent or dollars in

(before-tax, after-tax, Roth, catch-up). The rate represents the ratio of employees who are eligible to participate in relation to employees who are actively

participating (have a deferral and actively contributing or have reached the allowable limit).

Contribution rate Includes all actively employed participants with a deferral on the recordkeeping system.

The rate reflected includes percentages and flat dollar contributions (if we have a salary for the participant).

The average total contribution rate is calculated by adding together before-tax, after-tax, Roth and catch-up contribution type amounts available on the

recordkeeping system divided by the number of participants who made a contribution as of the last day of the month, excluding participants with a 0% deferral

and who have reached the annual contribution limit.

FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY. ©2023 EMPOWER, LLC. ALL RIGHTS RESERVED. 59