Page 171 - DCAC May 2023 Files

P. 171

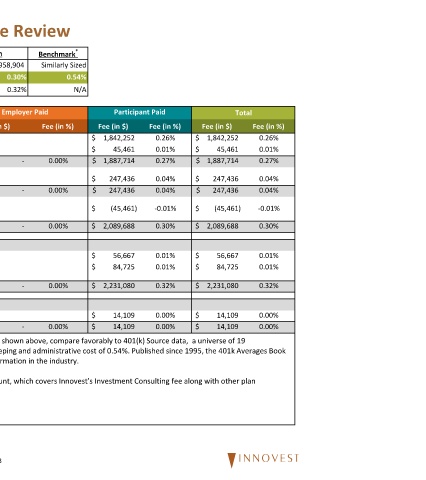

Fee (in %) 0.26% 0.01% 0.27% 0.04% 0.04% ‐0.01% 0.30% 0.01% 0.01% 0.32% 0.00% 0.00%

Total

Fee (in $) 1,842,252 45,461 1,887,714 247,436 247,436 (45,461) 2,089,688 56,667 84,725 2,231,080 14,109 14,109 a universe of 19

$ $ $ $ $ $ $ $ $ $ $ $

Participant Paid Fee (in %) 0.26% 0.01% 0.27% 0.04% 0.04% ‐0.01% 0.30% 0.01% 0.01% 0.32% 0.00% 0.00%

Fee (in $) 1,842,252 45,461 1,887,714 247,436 247,436 (45,461) 2,089,688 56,667 84,725 2,231,080 14,109 14,109

$ $ $ $ $ $ $ $ $ $ $ $

N/A

Benchmark * Similarly Sized 0.54% Fee (in %) 0.00% 0.00% 0.00% 0.00% 0.00%

County of San Mateo 457 Annual Fee Review

706,958,904 0.30% 0.32% Employer Paid ‐ ‐ ‐ ‐ ‐

Plan Fee (in $) recordkeepers with similarly sized 401(k) plans, with an average investment, recordkeeping and administrative cost of 0.54%. Published since 1995, the 401k Averages Book 8

$ $ $ $ $ $ **The County charges 0.02% on all assets that goes towards the Expense Budget Account, which covers Innovest's Investment Consulting fee along with other plan

Provider Fund Managers Empower Empower Empower Innovest Various Empower *The plan's estimated investment, recordkeeping and administrative costs of 0.30% as shown above, compare favorably to 401(k) Source data, is one of the oldest and recognized resources for comparative 401(k) average cost information in the industry.

Plan assets as of 12/31/2021 Investment, Recordkeeping and Administrative Costs Estimated Total Plan Expenses Expense ratio retained by fund manager Revenue sharing sent to recordkeeper Gross Investment Management Fees Recordkeeping/Administration Fee (0.035%) Gross Recordkeeping and Administrative Fees Revenue Sharing credited to participant accounts Total Investment, Recordkeeping and Administrative Costs Pro