Page 25 - DCAC May 2025 Files

P. 25

Executive summary Annual Data Point Review

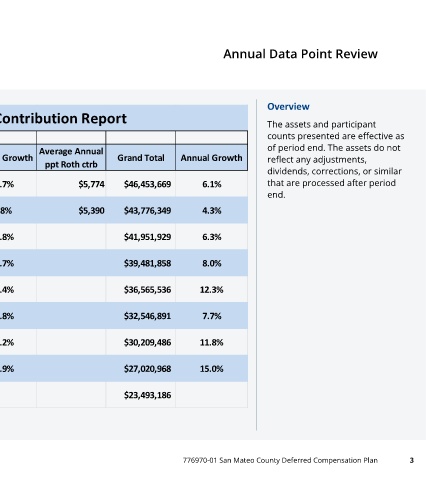

Overview

County of San Mateo 457 Plan Annual Contribution Report The assets and participant

Overview

counts presented are effective as

Average Annual Average Annual of period end. The assets do not

Calendar Year EE Pre-Tax Annual Growth EE Roth Annual Growth Grand Total Annual Growth The assets and participant

reflect any adjustments,

ppt pre-tax ctrb ppt Roth ctrb counts below are effective as of

dividends, corrections, or similar

that are processed after period

2024 $36,246,969 3.5% $7,965 $10,206,700 16.7% $5,774 $46,453,669 6.1% period end. The assets do not

reflect any adjustments,

end.

dividends, corrections, or similar

2023 $35,029,981 4.0% $7,694 $8,746,367 5.8% $5,390 $43,776,349 4.3% that are processed after period

end.

2022 $33,687,807 5.0% $8,264,122 11.8% $41,951,929 6.3%

2021 $32,091,752 6.7% $7,390,106 13.7% $39,481,858 8.0%

2020 $30,067,893 10.4% $6,497,642 22.4% $36,565,536 12.3%

2019 $27,239,623 5.2% $5,307,268 22.8% $32,546,891 7.7%

2018 $25,887,919 10.8% $4,321,567 18.2% $30,209,486 11.8%

2017 $23,364,647 12.3% $3,656,321 35.9% $27,020,968 15.0%

2016 $20,802,457 $2,690,728 $23,493,186

FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY. ©2025 EMPOWER, LLC. ALL RIGHTS RESERVED. 776970-01 San Mateo County Deferred Compensation Plan 3