Page 20 - DCAC Nov 2025 Files

P. 20

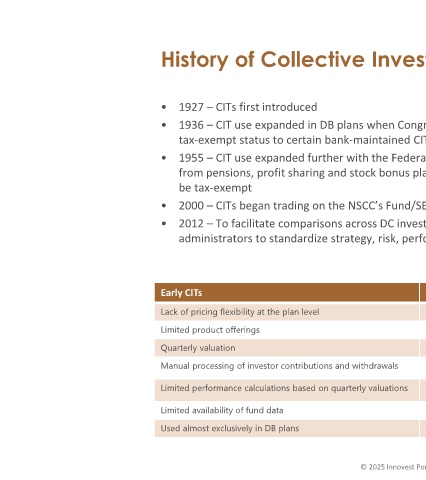

History of Collective Investment Trusts

• 1927 – CITs first introduced

• 1936 – CIT use expanded in DB plans when Congress amended the Internal Revenue Code to provide

tax‐exempt status to certain bank‐maintained CITs

• 1955 – CIT use expanded further with the Federal Reserve authorization for banks to combine funds

from pensions, profit sharing and stock bonus plans, and the IRS determination that such CITs could

be tax‐exempt

• 2000 – CITs began trading on the NSCC’s Fund/SERV® platform

• 2012 – To facilitate comparisons across DC investment alternatives, the DOL required plan

administrators to standardize strategy, risk, performance and expense disclosures for plan participants

Early CITs Modern CITs

Lack of pricing flexibility at the plan level Plan-level pricing flexibility often available

Limited product offerings Expanded universe of investment objectives

Quarterly valuation Daily valuation

Manual processing of investor contributions and withdrawals Potential for more standardized and automated daily processing

Limited performance calculations based on quarterly valuations Performance generally available due to daily valuations

Limited availability of fund data Fund fast sheets and enhanced data reporting

Used almost exclusively in DB plans Used in both DB and DC plans

© 2025 Innovest Portfolio Solutions, LLC 4