Page 117 - AugDefComp

P. 117

Vanguard Instl Trgt Retire 2025 Instl VRIVX 6/30/2021

Fund Incep Date: Benchmark: Category: Net Assets: Manager Name: Manager Start Date: Expense Ratio: Expense Rank:

06/26/2015 S&P Target Date 2025 Target-Date 2025 $51,717.00M William A. Coleman 06/26/2015 0.09% 3

PORTFOLIO COMPOSITION (Holdings-based) INVESTMENT OVERVIEW

Assets The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in other Vanguard mutual

funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2025 (the target year).

Cash 0.50% The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the

US Stocks 35.23% percentage of assets allocated to bonds and other fixed income investments will increase.

US Bonds 27.77%

Non-US Stocks 22.79%

Preferred Stocks 0.00% PERFORMANCE

Convertible Bonds 0.36%

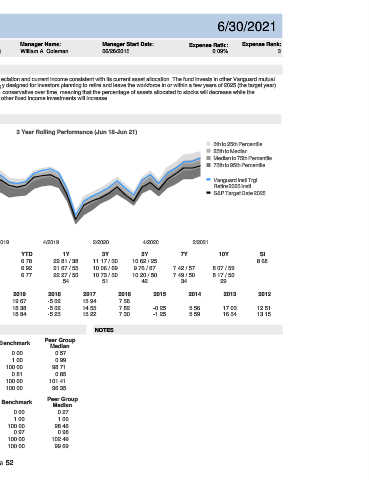

Other 0.02% 3 Year Rolling Performance (Jun 18-Jun 21)

Non-US Bonds 13.33% 14

Sector Breakdown 5th to 25th Percentile

Sensitive 12 25th to Median

Communication Services 9.06% Median to 75th Percentile

Industrials 11.12% 10 75th to 95th Percentile

Technology 18.71%

Energy 3.34% 8 Vanguard Instl Trgt

Retire 2025 Instl

Cyclical S&P Target Date 2025

6

Basic Materials 4.95%

Consumer Cyclical 12.00%

4

Real Estate 3.64%

Financial Services 16.07%

2

Defensive

Consumer Defensive 6.68% 0

Healthcare 11.77% 2/2018 4/2018 2/2019 4/2019 2/2020 4/2020 2/2021

Utilities 2.65%

3M YTD 1Y 3Y 5Y 7Y 10Y SI

TOP 10 HOLDINGS

Fund 4.79 6.78 22.81 / 38 11.17 / 30 10.62 / 25 8.68

Vanguard Total Stock Market Idx I 35.44%

Benchmark 4.43 6.92 21.67 / 55 10.06 / 69 9.76 / 67 7.42 / 57 8.07 / 59

Vanguard Total Bond Market II Idx Inv 28.63% Peer Group Median 4.79 6.77 22.27 / 50 10.73 / 50 10.20 / 50 7.49 / 50 8.17 / 50

Vanguard Total Intl Stock Index Inv 22.64%

Number of Funds 54 51 42 34 29

Vanguard Total Intl Bd II Idx Admiral 11.69%

Vanguard Shrt-Term Infl-Prot Sec Idx Adm 1.63% CALENDAR 2020 2019 2018 2017 2016 2015 2014 2013 2012

Fund 13.34 19.67 -5.02 15.94 7.56

Benchmark 11.22 18.38 -5.02 14.55 7.82 -0.25 5.56 17.03 12.51

Peer Group Median 13.06 18.84 -5.25 15.22 7.30 -1.25 5.59 16.54 13.15

RISK & PERFORMANCE STATISTICS NOTES

Total: 100.01%

Peer Group

3 Yr Fund Benchmark

ASSET LOADINGS (Returns-based) Median

Alpha 0.79 0.00 0.57

FUND EXPOSURES (WEIGHT) (Jul 18-Jun 21) Beta 1.03 1.00 0.99

100

75 R-Squared 99.70 100.00 98.71

Sharpe Ratio 0.88 0.81 0.85

50

25 Up Market Capture 105.41 100.00 101.41

0 Down Market Capture 99.62 100.00 96.35

Current Average

Fund Bmk Fund Bmk 5 Yr Fund Benchmark Peer Group

Cash 1.8 17.0 0.6 11.8 Median

US Bonds 31.9 17.2 32.1 24.5 Alpha 0.55 0.00 0.27

Intl Bonds 8.0 9.2 7.0 5.2 Beta 1.03 1.00 1.00

Intl Equity 16.2 14.3 19.3 16.6 R-Squared 99.50 100.00 98.48

US Equity 42.1 42.4 41.0 42.1 Sharpe Ratio 1.02 0.97 0.98

Up Market Capture 105.27 100.00 102.49

Down Market Capture 100.16 100.00 99.69

Page 52