Page 163 - FebDefComp

P. 163

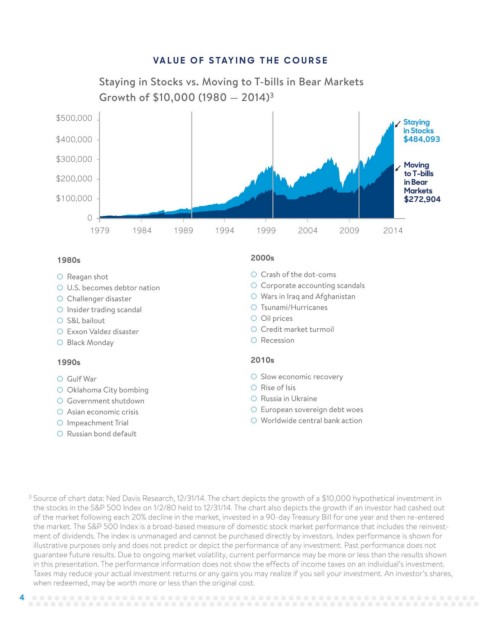

VA L UE OF S TAYING THE COURSE

Staying in Stocks vs. Moving to T-bills in Bear Markets

3

Growth of $10,000 (1980 — 2014)

$500,000

Staying

in Stocks

$400,000 $484,093

$300,000

Moving

to T-bills

$200,000 in Bear

Markets

$100,000 $272,904

0

1979 1984 1989 1994 1999 2004 2009 2014

1980s 2000s

○ Reagan shot ○ Crash of the dot-coms

○ U.S. becomes debtor nation ○ Corporate accounting scandals

○ Challenger disaster ○ Wars in Iraq and Afghanistan

○ Insider trading scandal ○ Tsunami/Hurricanes

○ S&L bailout ○ Oil prices

○ Exxon Valdez disaster ○ Credit market turmoil

○ Black Monday ○ Recession

1990s 2010s

○ Gulf War ○ Slow economic recovery

○ Oklahoma City bombing ○ Rise of Isis

○ Government shutdown ○ Russia in Ukraine

○ Asian economic crisis ○ European sovereign debt woes

○ Impeachment Trial ○ Worldwide central bank action

○ Russian bond default

3 Source of chart data: Ned Davis Research, 12/31/14. The chart depicts the growth of a $10,000 hypothetical investment in

the stocks in the S&P 500 Index on 1/2/80 held to 12/31/14. The chart also depicts the growth if an investor had cashed out

of the market following each 20% decline in the market, invested in a 90-day Treasury Bill for one year and then re-entered

the market. The S&P 500 Index is a broad-based measure of domestic stock market performance that includes the reinvest-

ment of dividends. The index is unmanaged and cannot be purchased directly by investors. Index performance is shown for

illustrative purposes only and does not predict or depict the performance of any investment. Past performance does not

guarantee future results. Due to ongoing market volatility, current performance may be more or less than the results shown

in this presentation. The performance information does not show the effects of income taxes on an individual’s investment.

Taxes may reduce your actual investment returns or any gains you may realize if you sell your investment. An investor’s shares,

when redeemed, may be worth more or less than the original cost.

4