Page 169 - FebDefComp

P. 169

News & Views | Q1 2020 Page 4 of 4

IRS Authorizes New Contribution Limits for 2020

The Internal Revenue Service has authorized an increase to the amount a person can contribute to retirement savings plans.

The new limits are

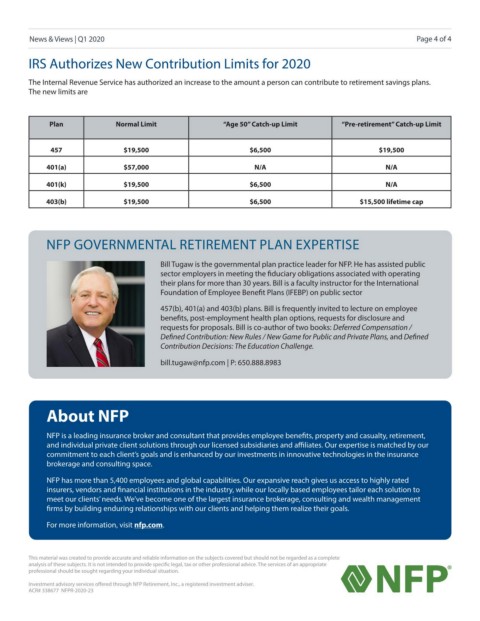

Plan Normal Limit “Age 50” Catch-up Limit “Pre-retirement” Catch-up Limit

457 $19,500 $6,500 $19,500

401(a) $57,000 N/A N/A

401(k) $19,500 $6,500 N/A

403(b) $19,500 $6,500 $15,500 lifetime cap

NFP GOVERNMENTAL RETIREMENT PLAN EXPERTISE

Bill Tugaw is the governmental plan practice leader for NFP. He has assisted public

sector employers in meeting the fiduciary obligations associated with operating

their plans for more than 30 years. Bill is a faculty instructor for the International

Foundation of Employee Benefit Plans (IFEBP) on public sector

457(b), 401(a) and 403(b) plans. Bill is frequently invited to lecture on employee

benefits, post-employment health plan options, requests for disclosure and

requests for proposals. Bill is co-author of two books: Deferred Compensation /

Defined Contribution: New Rules / New Game for Public and Private Plans, and Defined

Contribution Decisions: The Education Challenge.

bill.tugaw@nfp.com | P: 650.888.8983

About NFP

NFP is a leading insurance broker and consultant that provides employee benefits, property and casualty, retirement,

and individual private client solutions through our licensed subsidiaries and affiliates. Our expertise is matched by our

commitment to each client’s goals and is enhanced by our investments in innovative technologies in the insurance

brokerage and consulting space.

NFP has more than 5,400 employees and global capabilities. Our expansive reach gives us access to highly rated

insurers, vendors and financial institutions in the industry, while our locally based employees tailor each solution to

meet our clients’ needs. We’ve become one of the largest insurance brokerage, consulting and wealth management

firms by building enduring relationships with our clients and helping them realize their goals.

For more information, visit nfp.com.

This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete

analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate

professional should be sought regarding your individual situation.

Investment advisory services offered through NFP Retirement, Inc., a registered investment adviser.

ACR# 338677 NFPR-2020-23