Page 92 - FebDefComp

P. 92

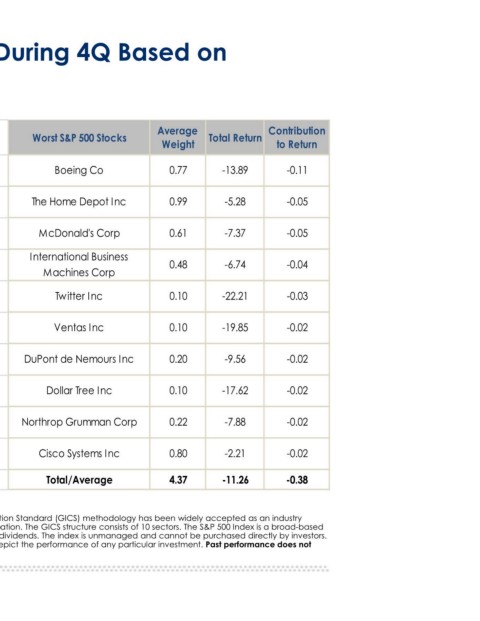

Contribution to Return -0.11 -0.05 -0.05 -0.04 -0.03 -0.02 -0.02 -0.02 -0.02 -0.02 -0.38

Total Return -13.89 -5.28 -7.37 -6.74 -22.21 -19.85 -9.56 -17.62 -7.88 -2.21 -11.26

Best & Worst S&P 500 Stocks During 4Q Based on

Average Weight 0.77 0.99 0.61 0.48 0.10 0.10 0.20 0.10 0.22 0.80 4.37

Worst S&P 500 Stocks Boeing Co The Home Depot Inc McDonald's Corp International Business Machines Corp Twitter Inc Ventas Inc DuPont de Nemours Inc Dollar Tree Inc Northrop Grumman Corp Cisco Systems Inc Total/Average

Contribution to Return 1.21 0.59 0.30 0.29 0.27 0.21 0.19 0.19 0.16 0.15 3.56 Source of chart data: Morningstar Direct, 12/31/2019. The Global Industry Classification Standard (GICS) methodology has been widely accepted as an industry analysis framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors. The S&P 500 Index is a broad-based measure of domestic stock market performance that includes the reinvestment of dividends. The index is unmanaged and cannot be purchased directly by investors. Index perform

Total Return 31.50 13.82 35.80 19.40 15.26 21.40 6.45 13.53 16.78 35.27 20.92

Contribution to Return

Average Weight 4.14 4.36 0.93 1.58 1.81 1.03 2.91 1.39 0.97 0.47 19.59 The mention of specific companies does not constitute a recommendation.

as of 12/31/2019 Best S&P 500 Stocks Apple Inc Microsoft Corp UnitedHealth Group Inc JPMorgan Chase & Co Facebook Inc A Bank of America Corp Amazon.com Inc Johnson & Johnson Intel Corp NVIDIA Corp Total/Average guarantee future results.