Page 67 - FebDefComp

P. 67

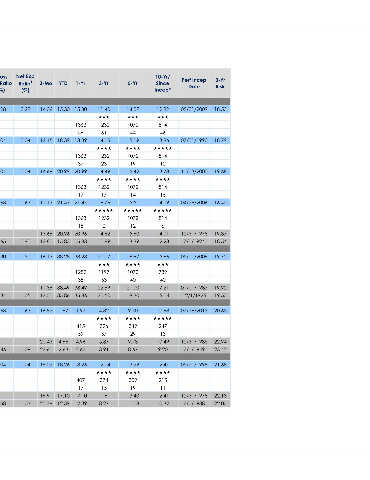

3-Yr Risk 18.53 18.79 19.68 16.45 19.37 18.54 19.72 19.92 19.55 20.63 22.94 23.42 21.68 22.13 22.05

Perf Incep Date 05/01/2009 07/31/1990 11/13/2000 04/28/2006 12/31/1978 7/1/1924 05/01/2009 01/01/1987 12/1/1925 07/26/2013 12/31/1985 7/1/1949 05/21/1998 12/31/1978 7/1/1938

10-Yr/ Since Incep* 12.82 ★★★ 814 46 13.86 ★★★★★ 814 12 13.78 ★★★★ 814 15 14.19 ★★★★★ 814 6 14.01 12.28 15.66 ★★★ 789 40 17.21 15.14 10.68 ★★★★★ 247 13 10.49 9.20 12.41 ★★★★ 215 11 12.41 10.32

5-Yr 14.07 ★★★ 1072 44 15.19 ★★★★ 1072 19 15.42 ★★★★ 1072 14 15.51 ★★★★★ 1072 12 15.60 13.39 18.97 ★★★★ 1070 40 21.00 18.30 9.70 ★★★★ 349 29 9.73 8.67 13.29 ★★★★ 309 19 13.40 11.08

3-Yr 11.40 ★★★ 1232 61 14.15 ★★★★ 1232 23 14.49 ★★★★ 1232 17 16.76 ★★★★★ 1232 2 14.82 11.89 20.07 ★★★ 1197 53 22.99 20.50 4.82 ★★★★ 396 37 5.37 3.91 12.04 ★★★★ 374 15 11.61 8.27

1-Yr 15.30 1363 59 18.39 1363 37 20.99 1363 17 21.47 1363 15 20.96 15.83 38.28 1289 35 38.49 35.86 1.97 415 59 4.96 2.63 18.26 407 17 17.10 12.39

YTD 15.30 18.39 20.99 21.47 20.96 15.83 38.28 38.49 35.86 1.97 4.96 2.63 18.26 17.10 12.39

3-Mo 14.06 12.15 14.69 11.13 13.69 12.81 16.13 11.39 12.50 16.82 20.43 22.60 18.02 19.91 20.78

Net Exp Ratio 1 (%) 0.28 0.04 0.04 0.63 0.90 0.30 1.05 0.63 1.09 0.04 1.03

Gross Exp Ratio (%) 0.28 0.04 0.04 0.63 1.65 0.30 1.34 0.63 1.46 0.04 1.58

Overall Morningstar Rating TM ★★★ ★★★★★ ★★★★ ★★★★★ ★★★ ★★★★ ★★★★

Ticker RFNGX VINIX VTSAX PRILX RGAGX AMDVX VMCIX

Share Class Type Retirement Inst Inst Inst Retirement Retirement Inst

Name / Benchmark & Morningstar Category Info American Funds Fundamental Invs R6 Morningstar Peer Rating % Vanguard Institutional Index I Morningstar Peer Rating % Vanguard Total Stock Mkt Idx Adm Morningstar Peer Rating % Parnassus Core Equity Institutional Morningstar Peer Rating % American Funds Growth Fund of Amer R6 Morningstar Peer Rating % Russell 1000 Growth TR USD American Century Mid Cap Value R6 Morningstar Peer Rating % Russell Mid Cap Value TR USD Vanguard Mid Cap Index Institutional Morningstar Peer Rating %

Performance As of: 12‐31‐2020

US OE Large Blend Morningstar Ratings # of Funds in Category Morningstar Ratings # of Funds in Category Morningstar Ratings # of Funds in Category Morningstar Ratings # of Funds in Category Russell 1000 TR USD US Fund Large Blend US OE Large Growth Morningstar Ratings # of Funds in Category US Fund Large Growth US OE Mid-Cap Value Morningstar Ratings # of Funds in Category US Fund Mid-Cap Value US OE Mid-Cap Blend Morningstar Ratings # of Funds in Category Russell Mid Cap TR USD US Fund Mid-Cap Blend

Inv. Type MF MF MF MF MF MF MF