Page 78 - FebDefComp

P. 78

2

RS-41492-03

Plan Trend

▲ 10% ▼ 2% ▼ 3% ▲ 84% ▼ 63% ▼ 7% ▼ 15% ▼ 14% ▲ 7% ▲ 95%

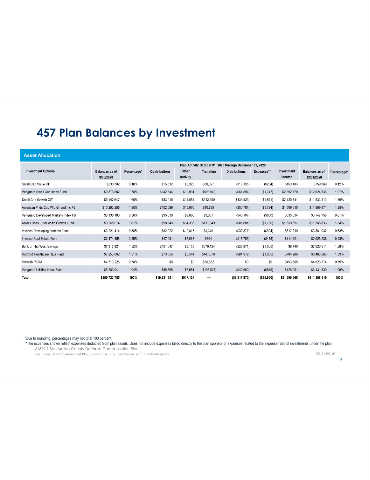

12/31/2020 $611,368,120 $33,827,193 $6,948,485 $9,608,303 $7,201,593 $1,581,629 $825,081 $1,575,087 $15,330 ($2,159,414) ($3,963,927) ($694,629) ($85,950) $51,299,568 plan assets. Expenses billed directly to the plan sponsor or expenses related to the expense ratio of investments under the plan are not reflected.

9/30/2020 $555,723,756 $29,048,643 $7,060,526 $9,883,676 $7,514,105 $1,670,540 $699,032 $855,862 $41,295 ($2,323,379) ($4,658,662) ($806,848) ($80,545) $26,343,221 Withdrawals = in-service withdrawal, death benefits, minimum distribution, installment payment, loan default expenses deducted from Contribution data displays the combined dollar value of Contributions & Loan Repayments, if applicable. Not for use with Plan Pa

Executive Summary

Plan Statistics Total Plan Assets Roth Assets Total Outstanding Loan Balances Participant Contributions Participant EE Pre-Tax Roth Loan Repayment Rollover Transferred Assets Distributions Withdrawals Terminations Loans Expenses* Investment Income Notes Terminations = termination and retirement *The expenses shown reflect The 61869-1-San Mateo County Deferred Compensation Plan For Financial Professional and P