Page 103 - MayDefComp

P. 103

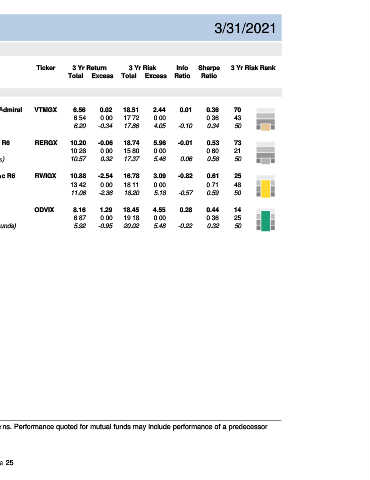

Risk Analysis 3/31/2021

Asset Class: International

Ticker 3 Yr Return 3 Yr Risk Info Sharpe 3 Yr Risk Rank

Total Excess Total Excess Ratio Ratio

RISK / RETURN (3-Year)

Vanguard Developed Markets Index Admiral VTMGX 6.56 0.02 18.51 2.44 0.01 0.36 70

11.0

MSCI EAFE 6.54 0.00 17.72 0.00 0.36 43

Foreign Large Blend Median (234 funds) RERGX 10.20 -0.34 17.86 4.05 -0.10 0.34 50 3 Yr

6.20

Return (Total Annualized Return, %) 5.5 MSCI EAFE Growth RWIGX 10.26 -2.54 15.80 0.00 -0.57 0.60 21 3 Yr

8.3

5.96

-0.06

18.74

American Funds Europacific Growth R6

-0.01

0.53

73

0.00

Foreign Large Growth Median (116 funds)

0.58

17.37

10.57

50

0.32

0.06

5.46

16.78

-0.82

10.88

25

3.09

0.61

American Funds Capital World Gr&Inc R6

0.71

48

18.11

0.00

0.00

13.42

MSCI World

18.20

World Large Stock Median (244 funds)

50

5.18

0.59

11.06

-2.36

2.8

Invesco Developing Markets R6

8.16

0.44

4.55

1.29

19.18

MSCI Emerging Markets ODVIX 6.87 0.00 18.45 0.00 0.28 0.36 14 3 Yr

25

0.0

Diversified Emerging Mkts Median (251 funds) 5.92 -0.95 20.02 5.48 -0.22 0.32 50

0.0 5.0 10.0 15.0 20.0

3 Yr

Risk (Total Annualized StdDev, %)

RISK / RETURN PEER RANK (3-Year)

1

Return Rank (Total Return Rank, %) 50

25

75

100

0.0 5.0 10.0 15.0 20.0

Risk (Total Annualized StdDev, %)

Past performance is no guarantee of future results. Rankings provided based on total returns. Performance quoted for mutual funds may include performance of a predecessor

fund/share class prior to the share class commencement of operations.

Page 25