Page 164 - NovDefComp

P. 164

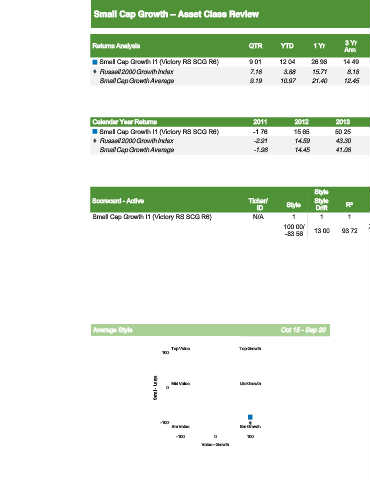

Small Cap Growth – Asset Class Review Sep-20

Manager

3 Yr 5 Yr 10 Yr Since Fund Net Exp. Gross

Returns Analysis QTR YTD 1 Yr Manager Name Tenure

Ann. Ann. Ann. Inception Inception Ratio Exp. Ratio

(Years)

Small Cap Growth I1 (Victory RS SCG R6) 9.01 12.04 26.96 14.49 14.97 15.80 14.49 Scott Tracy 13.25 11/30/1987 0.59 0.59

Russell 2000 Growth Index 7.16 3.88 15.71 8.18 11.42 12.34

Small Cap Growth Average 9.19 10.97 21.40 12.45 13.40 12.82 1.48 1.21

Calendar Year Returns 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD

Small Cap Growth I1 (Victory RS SCG R6) -1.76 15.65 50.25 10.20 1.03 1.57 37.92 -8.20 36.89 12.04

Russell 2000 Growth Index -2.91 14.59 43.30 5.60 -1.38 11.32 22.17 -9.31 28.48 3.88

Small Cap Growth Average -1.96 14.45 41.08 3.03 -2.69 9.85 22.99 -5.47 29.26 10.97

Style Risk/Return Peer Group Qual. Score

Scorecard - Active Ticker/ Style Style R² Risk/ Up/ Info Return Info Ratio (2pt. 09/30 06/30 03/31 12/31

ID Drift Return Down Ratio Rank Rank max) 2020 2020 2020 2019

Small Cap Growth I1 (Victory RS SCG R6) N/A 1 1 1 1 1 1 1 1 2 10 10 10 10

100.00/ 13.00 93.72 20.99/ 107.17/ 0.67 23.00 19.00 SCG SCG SCG

-83.56 14.97 94.59 SCG

Average Style Oct 15 - Sep 20 Style Drift 36 Month rolling windows, Oct 15 - Sep 20

Top Value Top Growth Top Value Top Growth

100 100

Small - Large 0 Mid Value Mid Growth Small - Large 0 Mid Value Mid Growth

-100 -100

Sm Value Sm Growth Sm Value Sm Growth

-100 0 100 -100 0 100

Value - Growth Value - Growth

60