Page 33 - DeferredComp-May2018

P. 33

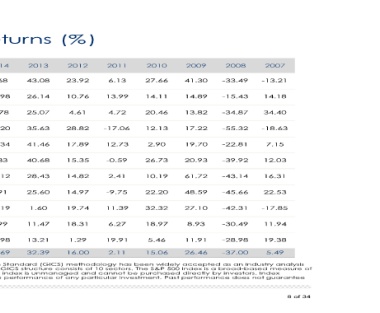

eturns (%)

14 2013 2012 2011 2010 2009 2008 2007

68 43.08 23.92 6.13 27.66 41.30 -33.49 -13.21

.98 26.14 10.76 13.99 14.11 14.89 -15.43 14.18

78 25.07 4.61 4.72 20.46 13.82 -34.87 34.40

.20 35.63 28.82 -17.06 12.13 17.22 -55.32 -18.63

.34 41.46 17.89 12.73 2.90 19.70 -22.81 7.15

83 40.68 15.35 -0.59 26.73 20.93 -39.92 12.03

.12 28.43 14.82 2.41 10.19 61.72 -43.14 16.31

91 25.60 14.97 -9.75 22.20 48.59 -45.66 22.53

.19 1.60 19.74 11.39 32.32 27.10 -42.31 -17.85

99 11.47 18.31 6.27 18.97 8.93 -30.49 11.94

.98 13.21 1.29 19.91 5.46 11.91 -28.98 19.38

.69 32.39 16.00 2.11 15.06 26.46 -37.00 5.49

n Standard (GICS) methodology has been widely accepted as an industry analysis

GICS structure consists of 10 sectors. The S&P 500 Index is a broad-based measure of

index is unmanaged and cannot be purchased directly by investors. Index

e performance of any particular investment. Past performance does not guarantee

8 of 34