Page 21 - MayDefComp

P. 21

2

Executive Summary

61869-1-San Mateo County Deferred Compensation Plan

Plan Statistics

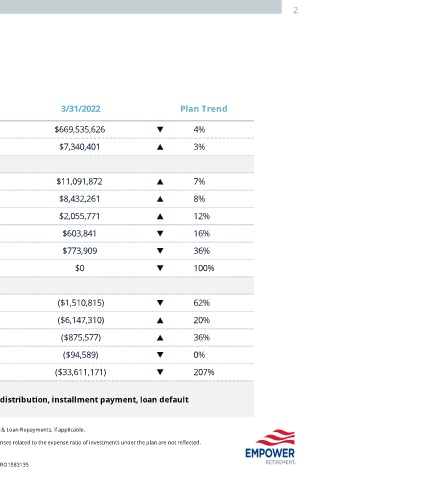

12/31/2021 3/31/2022 Plan Trend

Total plan assets $699,822,649 $669,535,626 q 4%

Total outstanding loan balances $7,136,257 $7,340,401 p 3%

Participant contributions

Participant $10,397,752 $11,091,872 p 7%

EE Pre-Tax $7,835,654 $8,432,261 p 8%

Roth $1,841,461 $2,055,771 p 12%

Loan Repayment $720,637 $603,841 q 16%

Rollover $1,209,754 $773,909 q 36%

Transferred assets $24,178 $0 q 100%

Distributions

Withdrawals ($3,931,056) ($1,510,815) q 62%

Terminations ($5,137,245) ($6,147,310) p 20%

Loans ($643,268) ($875,577) p 36%

Expenses* ($95,168) ($94,589) q 0%

Investment income $31,404,160 ($33,611,171) q 207%

Notes Terminations = termination and retirement

Withdrawals = in-service withdrawal, death benefits, minimum distribution, installment payment, loan default

Total plan assets exclude unallocated assets. The Contribution data displays the combined dollar value of Contributions & Loan Repayments, if applicable.

*The expenses shown reflect expenses deducted from plan assets. Expenses billed directly to the plan sponsor or expenses related to the expense ratio of investments under the plan are not reflected.

FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY.

RO1583135