Page 150 - DCAC December 2024 Files

P. 150

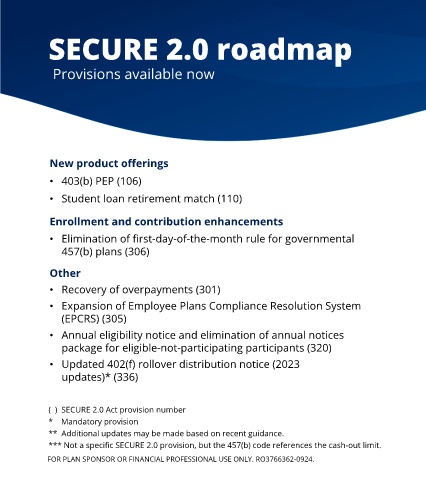

SECURE 2.0 roadmap

Provisions available now

New product offerings Distribution and withdrawal flexibility

• 403(b) PEP (106) • Required minimum distributions (RMDs)**

• Student loan retirement match (110) • Age increase to 73* (107), reduced excise tax* (302), Roth RMD

requirement* (325), spousal beneficiary (327), RMDs for special needs

Enrollment and contribution enhancements trust* (337)

• Elimination of first-day-of-the-month rule for governmental • Force-out increase from $5K to $7K (304)

457(b) plans (306) • Age 50 parity for private firefighters and emergency personnel (308)

Other • 457(b) de minimis distributions***

• Recovery of overpayments (301) • Qualified birth and adoption three-year repayment* (311)

• Expansion of Employee Plans Compliance Resolution System • Domestic abuse distributions (314)

(EPCRS) (305) • Terminally ill distributions (326)

• Annual eligibility notice and elimination of annual notices • Public safety officer’s distribution to pay healthcare premiums (328)

package for eligible-not-participating participants (320) • 10% penalty tax waiver for certain state and local correction employees

• Updated 402(f) rollover distribution notice (2023 and public safety/military corrections officers (329 and 330)

updates)* (336)

• Federal disaster distributions 10/15/24 (331)

• Recognition of tribal government domestic relations orders (339)

( ) SECURE 2.0 Act provision number

* Mandatory provision • 403(b) hardship distributions (602)

** Additional updates may be made based on recent guidance.

*** Not a specific SECURE 2.0 provision, but the 457(b) code references the cash-out limit.

FOR PLAN SPONSOR OR FINANCIAL PROFESSIONAL USE ONLY. RO3766362-0924.