Page 154 - DCAC December 2024 Files

P. 154

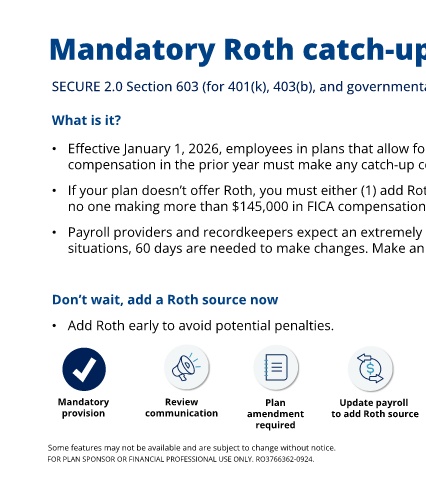

Mandatory Roth catch-up

SECURE 2.0 Section 603 (for 401(k), 403(b), and governmental 457(b) plans that offer age 50 catch-up contributions)

What is it?

• Effective January 1, 2026, employees in plans that allow for catch-up contributions who made over $145,000 in FICA

compensation in the prior year must make any catch-up contributions as Roth.

• If your plan doesn’t offer Roth, you must either (1) add Roth, (2) remove the catch-up provision, or (3) certify you have

no one making more than $145,000 in FICA compensation for 2025.

• Payroll providers and recordkeepers expect an extremely large volume of activity at the end of 2025. In some

situations, 60 days are needed to make changes. Make an election now to avoid delays or possible corrections.

Don’t wait, add a Roth source now

• Add Roth early to avoid potential penalties.

Mandatory Review Plan Update payroll

provision communication amendment to add Roth source

required

Some features may not be available and are subject to change without notice.

FOR PLAN SPONSOR OR FINANCIAL PROFESSIONAL USE ONLY. RO3766362-0924.