Page 45 - DCAC December 2024 Files

P. 45

Understanding Fiduciary Responsibilities

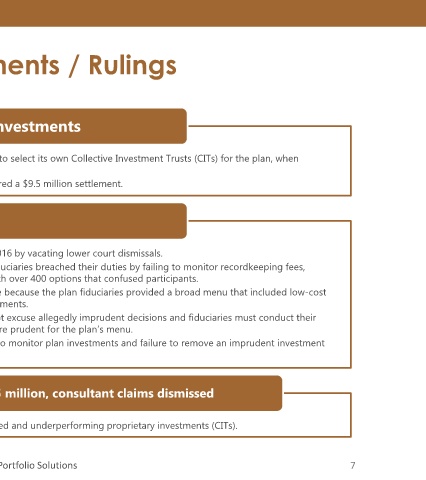

Notable and Recent Settlements / Rulings

Conflict of Interest: Proprietary Investments

•Plaintiffs alleged fiduciaries allowed the consultant (Aon) to select its own Collective Investment Trusts (CITs) for the plan, when

cheaper better-performing options were available.

•Aon Investment Consultants and their client, Astellas, shared a $9.5 million settlement.

Fees and Imprudent Investments

• The Supreme Court revived this excessive fee lawsuit filed in 2016 by vacating lower court dismissals.

• Northwestern retirement plan participants alleged that plan fiduciaries breached their duties by failing to monitor recordkeeping fees,

offering higher-cost, retail share classes, and having a menu with over 400 options that confused participants.

• District court and Seventh Circuit previously dismissed the case because the plan fiduciaries provided a broad menu that included low-cost

funds and participants had the ultimate choice over their investments.

• The Supreme Court ruled that offering a diverse menu does not excuse allegedly imprudent decisions and fiduciaries must conduct their

own independent evaluation to determine which investments are prudent for the plan’s menu.

• This decision reinforces that fiduciaries have an ongoing duty to monitor plan investments and failure to remove an imprudent investment

within a reasonable time is a fiduciary breach.

Conflict of Interest: Lowes settled for $12.5 million, consultant claims dismissed

• Plan fiduciaries allowed the consultant (Aon) to offer its untested and underperforming proprietary investments (CITs).

© 2024 Innovest Portfolio Solutions 7