Page 46 - DCAC December 2024 Files

P. 46

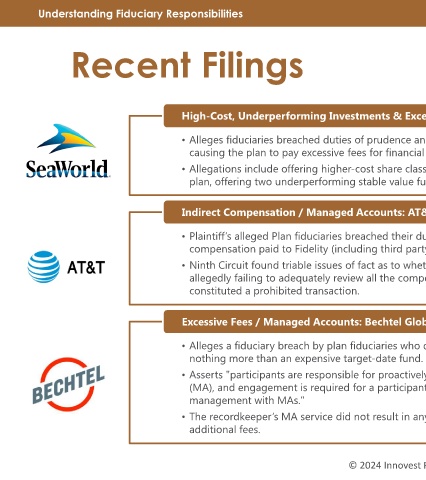

Understanding Fiduciary Responsibilities

Recent Filings

High-Cost, Underperforming Investments & Excessive Advisory Fees: SeaWorld

• Alleges fiduciaries breached duties of prudence and loyalty by selecting underperforming, high-cost investments and

causing the plan to pay excessive fees for financial advisory services.

• Allegations include offering higher-cost share classes, allowing four underperforming mutual funds to remain in the

plan, offering two underperforming stable value funds and overpaying for advisory fees.

Indirect Compensation / Managed Accounts: AT&T

• Plaintiff’s alleged Plan fiduciaries breached their duty of prudence by allegedly failing to adequately review all of the

compensation paid to Fidelity (including third party compensation paid by Edelman Financial Engines).

• Ninth Circuit found triable issues of fact as to whether the AT&T’s fiduciaries breached their duty of prudence by

allegedly failing to adequately review all the compensation paid to the recordkeeper, and that the arrangement

constituted a prohibited transaction.

Excessive Fees / Managed Accounts: Bechtel Global

• Alleges a fiduciary breach by plan fiduciaries who defaulted participants into a managed account option that was

nothing more than an expensive target-date fund.

• Asserts "participants are responsible for proactively entering data that is key to personalization of managed accounts

(MA), and engagement is required for a participant to have any chance at receiving any value from portfolio

management with MAs."

• The recordkeeper’s MA service did not result in any material personalization for Bechtel Plan participants to warrant

additional fees.

© 2024 Innovest Portfolio Solutions 8