Page 170 - DCAC May 2024 Files

P. 170

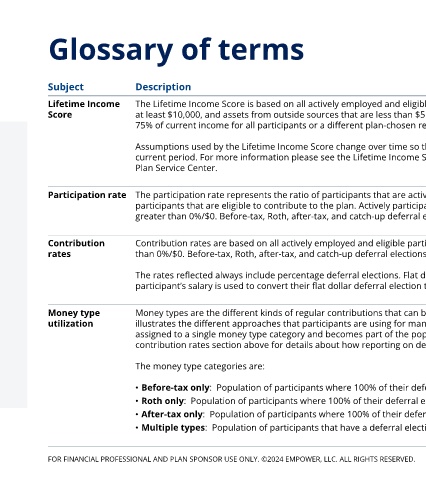

Glossary of terms

Subject Description

Lifetime Income The Lifetime Income Score is based on all actively employed and eligible participants that meet the following criteria: Date of birth on file, valid annual salary of

Score at least $10,000, and assets from outside sources that are less than $5 million. The Lifetime Income Score assumes a retirement income replacement rate of

75% of current income for all participants or a different plan-chosen replacement rate when applicable.

Assumptions used by the Lifetime Income Score change over time so the historical results provided may be based on assumptions that are different from the

current period. For more information please see the Lifetime Income Score Important Information and Disclosure located on the Data Library dashboard in the

Plan Service Center.

Participation rate The participation rate represents the ratio of participants that are actively participating in the plan compared to the total population of actively employed

participants that are eligible to contribute to the plan. Actively participating is defined as having a regular deferral election on the recordkeeping system that is

greater than 0%/$0. Before-tax, Roth, after-tax, and catch-up deferral elections are included.

Contribution Contribution rates are based on all actively employed and eligible participants that have a regular deferral election on the recordkeeping system that is greater

rates than 0%/$0. Before-tax, Roth, after-tax, and catch-up deferral elections are included.

The rates reflected always include percentage deferral elections. Flat dollar deferral elections are also included when a salary has been provided as a

participant’s salary is used to convert their flat dollar deferral election to a percentage election.

Money type Money types are the different kinds of regular contributions that can be made which differ from each other in how they are taxed. Money type utilization

utilization illustrates the different approaches that participants are using for managing the tax treatment of their future contributions. Each included participant is

assigned to a single money type category and becomes part of the population of participants that their respective category’s insights are based on. Refer to the

contribution rates section above for details about how reporting on deferral elections is handled.

The money type categories are:

• Before-tax only: Population of participants where 100% of their deferral election is setup to make before-tax contributions.

• Roth only: Population of participants where 100% of their deferral election is setup to make Roth contributions.

• After-tax only: Population of participants where 100% of their deferral election is setup to make after-tax contributions.

• Multiple types: Population of participants that have a deferral election setup to make contributions to two or more sources.

FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY. ©2024 EMPOWER, LLC. ALL RIGHTS RESERVED. 59