Page 174 - DCAC May 2024 Files

P. 174

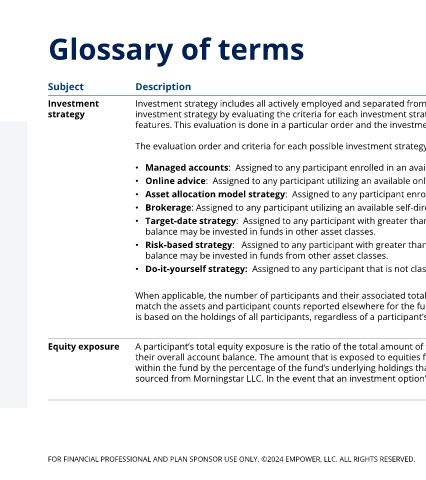

Glossary of terms

Subject Description

Investment Investment strategy includes all actively employed and separated from service plan participants with a balance. Each participant is assigned to a single

strategy investment strategy by evaluating the criteria for each investment strategy against the participant’s fund balances and their use of investment services and

features. This evaluation is done in a particular order and the investment strategy that ends up being assigned is the first one that has its criteria met.

The evaluation order and criteria for each possible investment strategy is as follows:

• Managed accounts: Assigned to any participant enrolled in an available managed account service.

• Online advice: Assigned to any participant utilizing an available online advice service.

• Asset allocation model strategy: Assigned to any participant enrolled in a model portfolio.

• Brokerage: Assigned to any participant utilizing an available self-directed brokerage account for any portion of their balance.

• Target-date strategy: Assigned to any participant with greater than 95% of their balance invested in one or two target-date funds. 5% of their remaining

balance may be invested in funds in other asset classes.

• Risk-based strategy: Assigned to any participant with greater than 95% of their balance invested in one or two risk-based funds. 5% of their remaining

balance may be invested in funds from other asset classes.

• Do-it-yourself strategy: Assigned to any participant that is not classified under any of the above investment strategies.

When applicable, the number of participants and their associated total balances that are assigned to the Target-date strategy or the Risk-based strategy will not

match the assets and participant counts reported elsewhere for the funds within the Target-date or Risk-based asset classes. This is because all fund reporting

is based on the holdings of all participants, regardless of a participant’s assigned investment strategy.

Equity exposure A participant’s total equity exposure is the ratio of the total amount of their balance (across all investment options) that is exposed to equities, compared to

their overall account balance. The amount that is exposed to equities for each individual investment option is calculated by multiplying the participant’s balance

within the fund by the percentage of the fund’s underlying holdings that are in equity asset classes. The underlying asset allocation of each investment option is

sourced from Morningstar LLC. In the event that an investment option’s asset allocation is unavailable, it is defaulted to having 50% allocated to equities.

FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY. ©2024 EMPOWER, LLC. ALL RIGHTS RESERVED. 61