Page 176 - DCAC May 2024 Files

P. 176

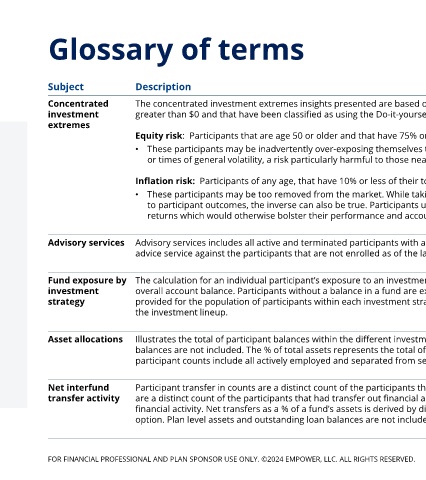

Glossary of terms

Subject Description

Concentrated The concentrated investment extremes insights presented are based on all actively employed and separated from service plan participants that have a balance

investment greater than $0 and that have been classified as using the Do-it-yourself investment strategy. Concentrated investment extremes are defined as:

extremes

Equity risk: Participants that are age 50 or older and that have 75% or more of their total balance exposed to equities.

• These participants may be inadvertently over-exposing themselves to too much equity (or market) risk, causing them to be vulnerable in market downturns

or times of general volatility, a risk particularly harmful to those nearest retirement.

Inflation risk: Participants of any age, that have 10% or less of their total balance exposed to equities.

• These participants may be too removed from the market. While taking on too much risk, as illustrated with the equity extreme definition, can be detrimental

to participant outcomes, the inverse can also be true. Participants underexposed to equities (or the market more broadly) can suffer from lack of investment

returns which would otherwise bolster their performance and account balance growth.

Advisory services Advisory services includes all active and terminated participants with a balance. It compares the participants enrolled in the managed account service or online

advice service against the participants that are not enrolled as of the last day of the reporting period. Each participant is only included in one group.

Fund exposure by The calculation for an individual participant’s exposure to an investment option is: Participant’s balance in the investment option divided by the participant’s

investment overall account balance. Participants without a balance in a fund are excluded when calculating the average for each fund. Average fund exposures are

strategy provided for the population of participants within each investment strategy to provide insights into how participants of each investment strategy are utilizing

the investment lineup.

Asset allocations Illustrates the total of participant balances within the different investment options and their associated asset class. Plan level assets and outstanding loan

balances are not included. The % of total assets represents the total of participant assets within the fund divided by the total of all participant balances. The

participant counts include all actively employed and separated from service plan participants with a balance greater than $0 in the fund.

Net interfund Participant transfer in counts are a distinct count of the participants that had transfer in financial activity during the timeframe. Participant transfer out counts

transfer activity are a distinct count of the participants that had transfer out financial activity during the timeframe. Net transfers are the net of the transfer in and transfer out

financial activity. Net transfers as a % of a fund’s assets is derived by dividing the net transfers amount by the total of participant balances within the investment

option. Plan level assets and outstanding loan balances are not included.

FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY. ©2024 EMPOWER, LLC. ALL RIGHTS RESERVED. 62