Page 75 - DCAC November 2024 Files

P. 75

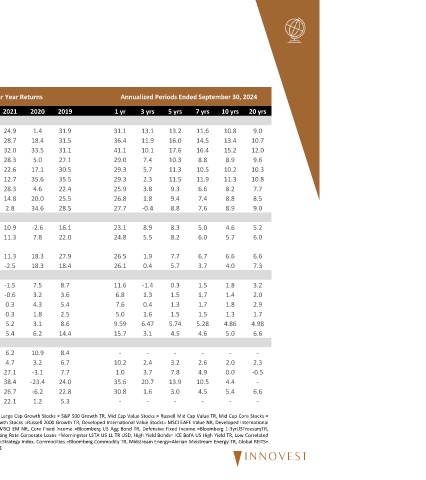

20 yrs 10 yrs 9.0 10.8 10.7 13.4 12.0 15.2 9.6 8.9 10.3 10.2 10.8 11.3 7.7 8.2 8.5 8.8 9.0 8.9 5.2 4.6 6.0 5.7 6.6 6.6 7.3 4.0 3.2 1.8 2.0 1.4 2.9 1.8 1.7 1.3 4.98 4.86 6.6 5.0 ‐ ‐ 2.3 2.0 ‐0.5 0.0 ‐ 4.4 6.6 5.4 ‐ ‐ 1‐3yrUSTreasuryTR,

Annualized Periods Ended September 30, 2024 7 yrs 5 yrs 11.6 13.2 14.5 16.0 16.4 17.6 8.8 10.3 10.5 11.3 11.9 11.5 6.6 9.3 7.4 9.4 7.6 8.8 5.0 8.3 6.0 8.2 6.7 7.7 3.7 5.7 1.5 0.3 1.7 1.5 1.7 1.3 1.5 1.5 5.28 5.74 4.6 4.5 ‐ ‐ 2.6 3.2 4.9 7.8 10.5 13.9 4.5 3.0 ‐ ‐ =Bloomberg Income Fixed

1 yr 3 yrs 13.1 31.1 11.9 36.4 10.1 41.1 7.4 29.0 5.7 29.3 2.3 29.3 3.8 25.9 1.8 26.8 ‐0.4 27.7 8.9 23.1 5.5 24.8 1.9 26.5 0.4 26.1 ‐1.4 11.6 1.3 6.8 0.4 7.6 1.6 5.0 6.47 9.59 3.1 15.7 ‐ ‐ 2.4 10.2 3.7 1.0 20.7 35.6 1.6 30.8 ‐ ‐ Defensive TR, Bond Agg

US

=Bloomberg

2019 31.9 31.5 31.1 27.1 30.5 35.5 22.4 25.5 28.5 16.1 22.0 27.9 18.4 8.7 3.6 5.4 2.5 8.6 14.4 8.4 6.7 7.7 24.0 22.8 5.3 Income

Fixed Core

‐23.4

2020

35.6

33.5

‐3.1

‐2.6

17.1

10.9

‐6.2

20.0

18.3

18.3

18.4

34.6

6.2

Calendar Year Returns 2021 24.9 28.7 32.0 28.3 22.6 12.7 28.3 14.8 2.8 10.9 11.3 11.3 ‐2.5 ‐1.5 ‐0.6 0.3 0.3 5.2 5.4 6.2 4.7 27.1 38.4 26.7 22.1 Returns based off the following indices: Large Cap Value Stocks = S&P 500 Value TR, Large Cap Core Stocks = S&P 500 TR, Large Cap Growth Stocks = S&P 500 Growth TR, Mid Cap Value Stocks = Russell Mid Cap Value TR, Mid Cap Core Stocks = Ru

7.8

7.5

3.2

4.3

1.8

3.2

1.4

1.2

5.0

4.6

3.1

‐11.2

‐24.3

‐13.0

‐20.1

‐17.3

‐26.7

‐14.5

‐18.1

‐29.4

‐12.0

‐20.4

‐26.4

‐22.9

‐14.5

2022

‐5.6

21.5

‐5.2

16.1

‐0.8

‐5.3

‐1.1

‐5.3

‐5.6

‐3.8

7.5

Markets Stocks=

2023 22.2 26.3 30.0 12.7 17.2 25.9 14.6 16.9 18.7 19.0 18.2 17.6 9.8 5.5 4.3 4.3 3.4 13.3 13.5 6.1 6.2 ‐7.9 14.0 11.6 ‐12.0 Emerging

NR,

Growth EAFE

Periods Ended September 30, 2024 YTD QTD 15.4 9.1 22.1 5.9 28.2 3.7 15.1 10.1 14.6 9.2 12.9 6.5 9.2 10.2 11.2 9.3 13.2 8.4 13.8 8.9 13.0 7.3 12.3 5.7 16.9 8.7 4.4 5.2 4.1 2.9 2.2 3.0 2.6 1.6 6.54 2.04 8.0 5.3 ‐ ‐ 6.3 2.6 5.9 0.7 27.4 9.7 13.1 16.5 ‐ ‐ Stocks=MSCI Growth S&P Developed Property TR, Direct Real Estate (Current Quarter, YTD, and Annualized

Investment Returns Over Time

Broad Market Indices Developed International Value Stocks Developed International Core Stocks Developed International Growth Defensive Municipal Fixed Income Floating Rate Corporate Loans Low Correlated Hedge Funds Liquid Low Correlated Hedge Funds International Developed NR, EAFE

Domestic Equities Large Cap Value Stocks Large Cap Core Stocks Large Cap Growth Stocks Mid Cap Value Stocks Mid Cap Core Stocks Mid Cap Growth Stocks Small Cap Value Stocks Small Cap Core Stocks Small Cap Growth Stocks International Equities Stocks Emerging Markets Stocks Fixed Income Core Fixed Income Defensive Fixed Income Municipal Fixed Income High Yield Fixed Income Diversifyin