Page 64 - DeferredComp-Feb2018

P. 64

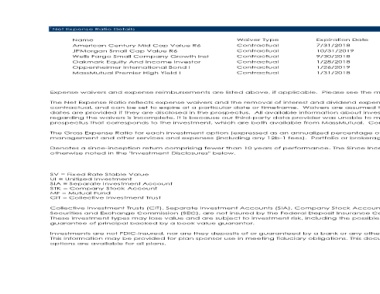

1Net Expense Ratio Details Waiver Type Expiration Date

Contractual 7/31/2018

Name Contractual 10/31/2019

American Century Mid Cap Value R6 Contractual 9/30/2018

JPMorgan Small Cap Value R6 Contractual 1/28/2018

Wells Fargo Small Company Growth Inst Contractual 1/26/2019

Oakmark Equity And Income Investor Contractual 1/31/2018

Oppenheimer International Bond I

MassMutual Premier High Yield I

Expense waivers and expense reimbursements are listed above, if applicable. Please see the m

The Net Expense Ratio reflects expense waivers and the removal of interest and dividend expen

contractual, and can be set to expire at a particular date or timeframe. Waivers are assumed t

dates are provided if they are disclosed in the prospectus. All available information about inves

regarding the waivers is incomplete, it is because our third-party data provider was unable to m

prospectus that corresponds to the investment, which are both available from MassMutual. Con

The Gross Expense Ratio for each investment option (expressed as an annualized percentage of

management and other services and expenses (including any 12b-1 fees). Portfolio or brokerag

Denotes a since-inception return comprising fewer than 10 years of performance. The Since Ince

otherwise noted in the "Investment Disclosures" below.

SV = Fixed Rate Stable Value

UI = Unitized Investment

SIA = Separate Investment Account

STK = Company Stock Account

MF = Mutual Fund

CIT = Collective Investment Trust

Collective Investment Trusts (CIT), Separate Investment Accounts (SIA), Company Stock Accoun

Securities and Exchange Commission (SEC), are not insured by the Federal Deposit Insurance Co

These investment types may lose value and are subject to investment risk, including the possible

guarantee of principal backed by a book value guarantor.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any othe

This information may be provided for plan sponsor use in meeting fiduciary obligations. This docu

options are available for all plans.