Page 141 - FebDefComp

P. 141

2/24/2020 Contract No. 061869-0001-0000

061869-0003-0000

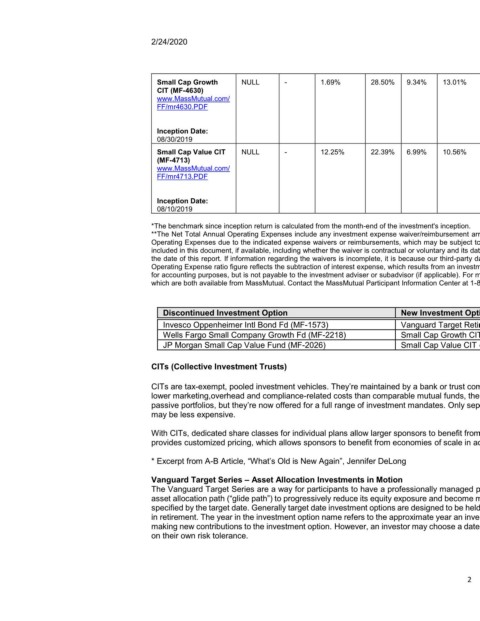

Small Cap Growth NULL - 1.69% 28.50% 9.34% 13.01% Russell 0.59% $5.90 0.59% $5.90 This investment will be

CIT (MF-4630) 2000® available as of 4/30/2020

www.MassMutual.com/ Growth

FF/mr4630.PDF Index

Inception Date:

08/30/2019

Small Cap Value CIT NULL - 12.25% 22.39% 6.99% 10.56% Russell 0.40% $4.00 0.40% $4.00 This investment will be

(MF-4713) 2000® available as of 4/30/2020

www.MassMutual.com/ Value Idx

FF/mr4713.PDF

Inception Date:

08/10/2019

*The benchmark since inception return is calculated from the month-end of the investment's inception.

**The Net Total Annual Operating Expenses include any investment expense waiver/reimbursement arrangements documented in the investment’s prospectus and may be lower than the Gross Total Annual

Operating Expenses due to the indicated expense waivers or reimbursements, which may be subject to expiration. Additional information regarding investment expense waivers specific to each investment is

included in this document, if available, including whether the waiver is contractual or voluntary and its date of expiration. All available information about investment expense waivers is current and complete as of

the date of this report. If information regarding the waivers is incomplete, it is because our third-party data provider was unable to make the information available. For some investments, the Net Total Annual

Operating Expense ratio figure reflects the subtraction of interest expense, which results from an investment’s use of certain other investments. This expense is required to be treated as an investment expense

for accounting purposes, but is not payable to the investment adviser or subadvisor (if applicable). For more information, please see the investment profile or the prospectus that corresponds to the investment,

which are both available from MassMutual. Contact the MassMutual Participant Information Center at 1-888-606-7343.

Discontinued Investment Option New Investment Option

Invesco Oppenheimer Intl Bond Fd (MF-1573) Vanguard Target Retirement Fund Based on Age

Wells Fargo Small Company Growth Fd (MF-2218) Small Cap Growth CIT (MF-4630)

JP Morgan Small Cap Value Fund (MF-2026) Small Cap Value CIT (MF-4713)

CITs (Collective Investment Trusts)

CITs are tax-exempt, pooled investment vehicles. They’re maintained by a bank or trust company exclusively for qualified retirement plans and certain types of government plans. With

lower marketing,overhead and compliance-related costs than comparable mutual funds, they’re more economical for investors. Originally, plans used CITs mainly for stable-value and

passive portfolios, but they’re now offered for a full range of investment mandates. Only separately managed accounts, which require much higher asset minimums for most managers,

may be less expensive.

With CITs, dedicated share classes for individual plans allow larger sponsors to benefit from flexible pricing, just as they do in a separately managed account. A dedicated share class

provides customized pricing, which allows sponsors to benefit from economies of scale in advisory fees and from the lower operating costs that come with a larger investment pool. *

* Excerpt from A-B Article, “What’s Old is New Again”, Jennifer DeLong

Vanguard Target Series – Asset Allocation Investments in Motion

The Vanguard Target Series are a way for participants to have a professionally managed portfolio designed for their retirement time horizon. Each option in this series follows its own

asset allocation path (“glide path”) to progressively reduce its equity exposure and become more conservative over time, reaching its most conservative allocation 10 years after the year

specified by the target date. Generally target date investment options are designed to be held beyond the presumed retirement date to offer a continuing investment option for the investor

in retirement. The year in the investment option name refers to the approximate year an investor in the option would plan to retire (assuming a retirement age of 65) and likely would stop

making new contributions to the investment option. However, an investor may choose a date other than their presumed retirement date to be more conservative or aggressive depending

on their own risk tolerance.

2 Exp 4/01/2021