Page 82 - FebDefComp

P. 82

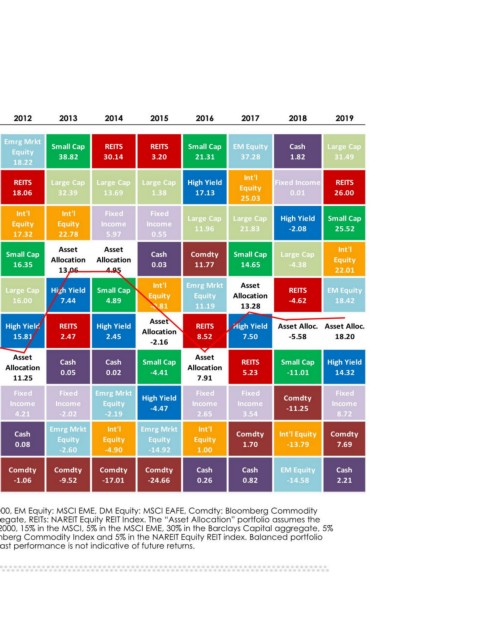

2019 Large Cap 31.49 REITS 26.00 Small Cap 25.52 Int'l Equity 22.01 EM Equity 18.42 Asset Alloc. 18.20 High Yield 14.32 Fixed Income 8.72 Comdty 7.69 Cash 2.21

2018 Cash 1.82 Fixed Income 0.01 High Yield ‐2.08 Large Cap ‐4.38 REITS ‐4.62 Asset Alloc. ‐5.58 Small Cap ‐11.01 Comdty ‐11.25 Int'l Equity ‐13.79 EM Equity ‐14.58

EM Equity 37.28 Int'l Equity 25.03 Large Cap Small Cap 14.65 Asset Allocation 13.28 High Yield REITS Fixed Income Comdty Cash in the Barclays Capital aggregate, 5%

2017 21.83 7.50 5.23 3.54 1.70 0.82

2016 Small Cap 21.31 High Yield 17.13 Large Cap 11.96 Comdty 11.77 Emrg Mrkt Equity 11.19 REITS 8.52 Asset Allocation 7.91 Fixed Income 2.65 Int'l Equity 1.00 Cash 0.26

2015 REITS 3.20 Large Cap 1.38 Fixed Income 0.55 Cash 0.03 Int'l Equity ‐0.81 Asset Allocation ‐2.16 Small Cap ‐4.41 High Yield ‐4.47 Emrg Mrkt Equity ‐14.92 Comdty ‐24.66

2014 REITS 30.14 Large Cap 13.69 Fixed Income 5.97 Asset Allocation 4.95 Small Cap 4.89 High Yield 2.45 Cash 0.02 Emrg Mrkt Equity ‐2.19 Int'l Equity ‐4.90 Comdty ‐17.01

2013 Small Cap 38.82 Large Cap 32.39 Int'l Equity 22.78 Asset Allocation 13.06 High Yield 7.44 REITS 2.47 Cash 0.05 Fixed Income ‐2.02 Emrg Mrkt Equity ‐2.60 Comdty ‐9.52

Emrg Mrkt Equity REITS Int'l Equity Small Cap Large Cap High Yield Allocation Fixed Comdty

2012 18.22 18.06 17.32 16.35 16.00 15.81 Asset 11.25 Income 4.21 Cash 0.08 ‐1.06 Source: Morningstar Direct, 12/31/2019. Large cap: S&P 500, Small cap: Russell 2000, EM Equity: MSCI EME, DM Equity: MSCI EAFE, Comdty: Bloomberg Commodity Index, High Yield: Barclays High Yield Index, Fixed Income: Barclays Capital Aggregate, REITs: NAREIT Equity REIT Index. The “Asset Allocation” portfolio assumes the in the Barclays 1-3m Treasury, 5% in the Barclays High Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NAREIT Equity REIT index. Balanced portfolio

2011 REITS 8.29 Fixed Income 7.84 High Yield 4.98 Large Cap 2.11 Cash 0.07 Asset Allocation ‐0.38 Small Cap ‐4.18 Int'l Equity ‐12.14 Comdty ‐13.32 Emrg Mrkt Equity ‐18.42

2010 REITS 27.96 Small Cap 26.85 Emrg Mrkt Equity 18.88 Comdty 16.83 High Yield 15.12 Large Cap 15.06 Asset Allocation 12.77 Int'l Equity 7.75 Fixed Income 6.54 Cash 0.13 following weights (60% Equity, 40% Bonds): 20% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI, 5% in the MSCI EME, 30% assumes annual rebalancing. All data represents total return for stated period. Past performance is not indicative of future returns.

Emrg Mrkt Equity 78.51 High Yield 58.21 Int'l Equity 31.78 REITS Small Cap 27.17 Large Cap Asset Allocation 23.74 Comdty Fixed Income Cash

2009 27.99 26.46 18.91 5.93 0.15

Asset Class Returns

2008 Fixed Income 5.24 Cash 1.77 Asset Allocation ‐23.27 High Yield ‐26.16 Small Cap ‐33.79 Comdty ‐35.65 Large Cap ‐37.00 REITS ‐37.73 Int'l Equity ‐43.38 Emrg Mrkt Equity ‐53.33

2007 Emrg Mrkt Equity 39.42 Comdty 16.23 Int'l Equity 11.17 Asset Allocation 7.04 Fixed Income 6.97 Large Cap 5.49 Cash 4.78 High Yield 1.87 Small Cap ‐1.57 REITS ‐15.69 Diversification does not guarantee a profit or protect against loss. Past performance does not guarantee future results.

as of 12/31/2019 2006 2005 Emrg Mrkt REITS Equity 35.06 34.00 Emrg Mrkt Comdty Equity 21.36 32.14 Int'l Int'l Equity Equity 26.34 13.54 Small Cap REITS 18.37 12.16 Asset Large Cap Allocation 15.79 7.86 Asset Large Cap Allocation 4.91 14.54 High Yield Small Cap 11.85 4.55 Cash Cash 4.80 3.00 Fixed High Yield Income 2.74 4.33 Fixed Comdty Income 2.07 2.43

2004 REITS 31.58 Emrg Mrkt Equity 25.55 Int'l Equity 20.25 Small Cap 18.33 Asset Allocation 12.28 High Yield 11.13 Large Cap 10.88 Comdty 9.15 Fixed Income 4.34 Cash 1.24