Page 38 - FebDefComp

P. 38

11

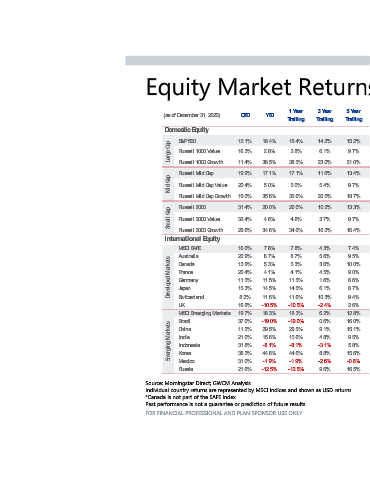

Equity Market Returns

ear ear 10 Y 2014 2015 2016 2017 2018 2019 2020 railing T Trailing 13.7% 1.4% 12.0% 21.8% -4.4% 31.5% 18.4% 13.9% 15.2% 13.5% -3.8% 17.3% 13.7% -8.3% 26.5% 2.8% 10.5% 9.7% 13.0% 5.7% 7.1% 30.2% -1.5% 36.4% 38.5% 17.2% 21.0% 13.2% -2.4% 13.8% 18.5% -9.1% 30.5% 17.1% 12.4% 13.4% 14.7% -4.8% 20.0% 13.3% -12.3% 27.1% 5.0% 10.5% 9.7% 11.9% -0.2% 7.3% 25.3% -4.8% 35.5% 35.6% 15.0% 18.7% 4.9% -4.4% 21.3% 14.6% -11.0% 25.5% 20.0% 11.2% 13.3% 4.2% -7.5% 31.7% 7.8% -12.9% 22.4% 4.6% 8.7% 9.7% 5.6% -1.4% 11.3% 22.2% -9.3% 28.5% 34.6% 13.5% 16.4% -4.9% -0.8% 1.0% 25.0% -13.8% 22.0% 7.8% 5.5% 7.4% -3.4% -10.0% 11.4% 19.9% -12.0% 22.9% 8.7% 4.5% 9.5% 1.5% -24.2% 24.6% 16.1% -17.2% 27.5% 5.3% 2.2% 10.0% -9

5 Y

ear Trailing 14.2% 6.1% 23.0% 11.6% 5.4% 20.5% 10.2% 3.7% 16.2% 4.3% 5.6% 3.6% 4.5% 1.6% 6.1% 10.3% -2.4% 6.2% 0.6% 9.1% 4.8% -3.1% 8.8% -2.6% 9.6%

3 Y

ear Trailing 18.4% 2.8% 38.5% 17.1% 5.0% 35.6% 20.0% 4.6% 34.6% 7.8% 8.7% 5.3% 4.1% 11.5% 14.5% 11.6% -10.5% 18.3% -19.0% 29.5% 15.6% -8.1% 44.6% -1.9% -12.5%

1 Y

D

T 18.4% 2.8% 38.5% 17.1% 5.0% 35.6% 20.0% 4.6% 34.6% 7.8% 8.7% 5.3% 4.1% 11.5% 14.5% 11.6% -10.5% 18.3% -19.0% 29.5% 15.6% -8.1% 44.6% -1.9% -12.5%

Y

D Individual country returns are represented by MSCI indices and shown as USD returns

QT 12.1% 16.3% 11.4% 19.9% 20.4% 19.0% 31.4% 33.4% 29.6% 16.0% 22.9% 13.9% 20.4% 11.5% 15.3% 8.2% 16.9% 19.7% 37.0% 11.2% 21.0% 31.8% 38.3% 31.0% 21.6% Past performance is not a guarantee or prediction of future results. FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY.

ecember 31, 2020) uity q E tic &P500 ussell 1000 Value ussell 1000 Gowth r ap Russell Mid C ap Value Russell Mid C ap Gowth r Russell Mid C ussell 2000 ussell 2000 Value ussell 2000 Gowth r uity q nal E E AF I E C Australia anada rance ermany erland merging Markets I E C i hina Indonesia Mexico ussia Source: Morningstar Direct; GWCM Analysis *Canada is not part of the EAFE Index

(as of D mes o D S R L arge C ap R Mid C ap R R S mall C ap R Internatio MS C F G apan J D eveloped Markets witz S K U MS Brazl C India Korea E merging Markets R