Page 52 - MayDefComp

P. 52

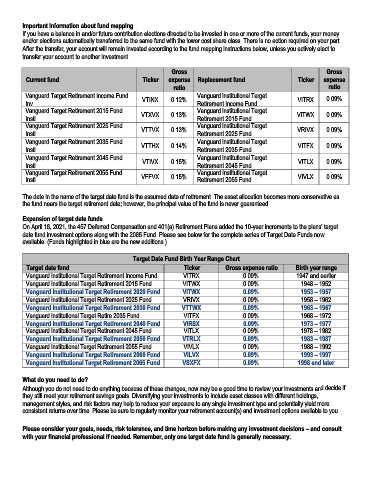

Important information about fund mapping

If you have a balance in and/or future contribution elections directed to be invested in one or more of the current funds, your money

and/or elections automatically transferred to the same fund with the lower cost share class. There is no action required on your part.

After the transfer, your account will remain invested according to the fund mapping instructions below, unless you actively elect to

transfer your account to another investment.

Gross Gross

Current fund Ticker expense Replacement fund Ticker expense

ratio ratio

Vanguard Target Retirement Income Fund VTINX 0.12% Vanguard Institutional Target VITRX 0.09%

Inv Retirement Income Fund

Vanguard Target Retirement 2015 Fund Vanguard Institutional Target

Instl VTXVX 0.13% Retirement 2015 Fund VITWX 0.09%

Vanguard Target Retirement 2025 Fund Vanguard Institutional Target

Instl VTTVX 0.13% Retirement 2025 Fund VRIVX 0.09%

Vanguard Target Retirement 2035 Fund VTTHX 0.14% Vanguard Institutional Target VITFX 0.09%

Instl Retirement 2035 Fund

Vanguard Target Retirement 2045 Fund VTIVX 0.15% Vanguard Institutional Target VITLX 0.09%

Instl Retirement 2045 Fund

Vanguard Target Retirement 2055 Fund Vanguard Institutional Target

Instl VFFVX 0.15% Retirement 2055 Fund VIVLX 0.09%

The date in the name of the target date fund is the assumed date of retirement. The asset allocation becomes more conservative as

the fund nears the target retirement date; however, the principal value of the fund is never guaranteed.

Expansion of target date funds

On April 16, 2021, the 457 Deferred Compensation and 401(a) Retirement Plans added the 10-year increments to the plans’ target

date fund investment options along with the 2065 Fund. Please see below for the complete series of Target Date Funds now

available. (Funds highlighted in blue are the new additions.)

Target Date Fund Birth Year Range Chart

Target date fund Ticker Gross expense ratio Birth year range

Vanguard Institutional Target Retirement Income Fund VITRX 0.09% 1947 and earlier

Vanguard Institutional Target Retirement 2015 Fund VITWX 0.09% 1948 – 1952

Vanguard Institutional Target Retirement 2020 Fund VITWX 0.09% 1953 – 1957

Vanguard Institutional Target Retirement 2025 Fund VRIVX 0.09% 1958 – 1962

Vanguard Institutional Target Retirement 2030 Fund VTTWX 0.09% 1963 – 1967

Vanguard Institutional Target Retire 2035 Fund VITFX 0.09% 1968 – 1972

Vanguard Institutional Target Retirement 2040 Fund VIRSX 0.09% 1973 – 1977

Vanguard Institutional Target Retirement 2045 Fund VITLX 0.09% 1978 – 1982

Vanguard Institutional Target Retirement 2050 Fund VTRLX 0.09% 1983 – 1987

Vanguard Institutional Target Retirement 2055 Fund VIVLX 0.09% 1988 – 1992

Vanguard Institutional Target Retirement 2060 Fund VILVX 0.09% 1993 – 1997

Vanguard Institutional Target Retirement 2065 Fund VSXFX 0.09% 1998 and later

What do you need to do?

Although you do not need to do anything because of these changes, now may be a good time to review your investments and decide if

they still meet your retirement savings goals. Diversifying your investments to include asset classes with different holdings,

management styles, and risk factors may help to reduce your exposure to any single investment type and potentially yield more

consistent returns over time. Please be sure to regularly monitor your retirement account(s) and investment options available to you.

Please consider your goals, needs, risk tolerance, and time horizon before making any investment decisions – and consult

with your financial professional if needed. Remember, only one target date fund is generally necessary.