Page 67 - MayDefComp

P. 67

Market Overview 3/31/2021

International Snapshot

INTERNATIONAL

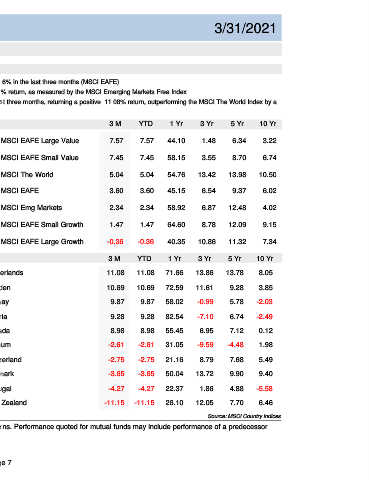

Developed international equity underperformed U.S. equity by a small margin, returning a positive 3.6% in the last three months (MSCI EAFE).

Emerging market equity, a riskier asset class focused in developing markets, posted a positive 2.34% return, as measured by the MSCI Emerging Markets Free Index.

Out of all countries in the MSCI The World index, Netherlands achieved the highest growth in the last three months, returning a positive 11.08% return, outperforming the MSCI The World Index by a

margin of 6.04%.

INDEX PERFORMANCE (Sorted by trailing 3M performance) 3 M YTD 1 Yr 3 Yr 5 Yr 10 Yr

70% 64.6% MSCI EAFE Large Value 7.57 7.57 44.10 1.48 6.34 3.22

60% 58.2% 54.8% 58.9%

MSCI EAFE Small Value 7.45 7.45 58.15 3.55 8.70 6.74

50%

44.1% 45.2%

40.3%

40% MSCI The World 5.04 5.04 54.76 13.42 13.98 10.50

30%

MSCI EAFE 3.60 3.60 45.15 6.54 9.37 6.02

20%

10% 7.6% 7.5% 5.0% 3.6% 2.3% 1.5% MSCI Emg Markets 2.34 2.34 58.92 6.87 12.48 4.02

0%

-0.4% MSCI EAFE Small Growth 1.47 1.47 64.60 8.78 12.09 9.15

-10%

3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr MSCI EAFE Large Growth -0.36 -0.36 40.35 10.86 11.32 7.34

TOP 5 & BOTTOM 5 COUNTRIES (Sorted by trailing 3M Performance) 3 M YTD 1 Yr 3 Yr 5 Yr 10 Yr

11.1% Netherlands 11.08 11.08 71.66 13.86 13.78 8.05

10.7% Sweden 10.69 10.69 72.59 11.61 9.28 3.85

9.9% Norway 9.87 9.87 58.02 -0.99 5.78 -2.03

9.3%

Austria 9.28 9.28 82.54 -7.10 6.74 -2.49

9.0%

Canada 8.98 8.98 55.45 6.95 7.12 0.12

-2.6%

Belgium -2.61 -2.61 31.05 -9.59 -4.48 1.98

-2.7%

Switzerland -2.75 -2.75 21.16 8.79 7.68 5.49

-3.7%

Denmark -3.65 -3.65 50.04 13.72 9.90 9.40

-4.3%

Portugal -4.27 -4.27 22.37 1.86 4.88 -5.58

-11.1%

-15.00 -10.00 -5.00 0.00 5.00 10.00 15.00 New Zealand -11.15 -11.15 26.10 12.05 7.70 6.46

Source: MSCI Country Indices.

Past performance is no guarantee of future results. Rankings provided based on total returns. Performance quoted for mutual funds may include performance of a predecessor

fund/share class prior to the share class commencement of operations.

Page 7