Page 115 - NovDefComp

P. 115

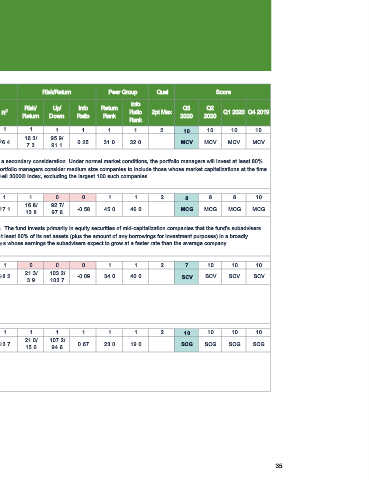

Scorecard - 401(a) Plan

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style Risk/ Up/ Info Return Q3 Q2

Style R 2 Ratio 2pt Max Q1 2020 Q4 2019

Drift Return Down Ratio Rank 2020 2020

Rank

1 1 1 1 1 1 1 1 2 10 10 10 10

American Century Mid

$4,075.00 MCV AMDVX -88.3/ 16.3/ 95.9/

Cap Value R6 9.6 96.4 0.25 31.0 32.0 MCV MCV MCV MCV

24.7 7.3 91.1

The investment seeks long-term capital growth; income is a secondary consideration. Under normal market conditions, the portfolio managers will invest at least 80%

Strategy Review of the fund's net assets in medium size companies. The portfolio managers consider medium size companies to include those whose market capitalizations at the time

of purchase are within the capitalization range of the Russell 3000® Index, excluding the largest 100 such companies.

1 1 1 1 0 0 1 1 2 8 8 8 10

MassMutual Select Mid

$14,588.00 MCG MEFZX 53.6/ 16.8/ 92.7/

Cap Growth I 17.4 97.1 -0.58 45.0 46.0 MCG MCG MCG MCG

4.3 13.8 97.6

The investment seeks growth of capital over the long-term. The fund invests primarily in equity securities of mid-capitalization companies that the fund's subadvisers

Strategy Review believe offer the potential for long-term growth. It invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in a broadly

diversified portfolio of common stocks of mid-cap companies whose earnings the subadvisers expect to grow at a faster rate than the average company.

1 1 1 0 0 0 1 1 2 7 10 10 10

Small Cap Value I1 (BMO

$7,599.00 SCV 97181N296 -87.9/ 21.3/ 103.2/

Disciplined SCV) 8.4 98.2 -0.09 34.0 40.0 SCV SCV SCV SCV

-94.4 3.9 103.7

Strategy Review

1 1 1 1 1 1 1 1 2 10 10 10 10

Small Cap Growth I1

$14,934.00 SCG 97181N361 100.0/ 21.0/ 107.2/

(Victory RS SCG R6) 13.0 93.7 0.67 23.0 19.0 SCG SCG SCG SCG

-83.6 15.0 94.6

Strategy Review

35