Page 118 - NovDefComp

P. 118

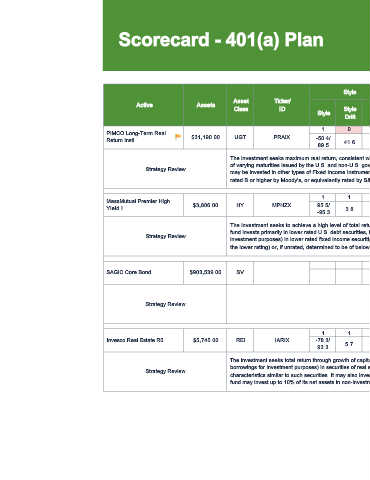

Scorecard - 401(a) Plan

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style Risk/ Up/ Info Return Q3

Style R 2 Ratio 2pt Max Q2 2020 Q1 2020 Q4 2019

Drift Return Down Ratio Rank 2020

Rank

1 0 1 1 1 1 1 1 1 8 6 5 6

PIMCO Long-Term Real

$31,190.00 UGT PRAIX -50.4/ 9.1/ 215.5/

Return Instl 41.6 82.9 0.84 1.0 4.0 T UGT UGT UGT UGT

89.5 9.6 209.0

The investment seeks maximum real return, consistent with prudent investment management. The fund invests at least 80% of its net assets in inflation-indexed bonds

of varying maturities issued by the U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations. Assets not invested in inflation-indexed bonds

Strategy Review

may be invested in other types of Fixed Income Instruments. It invests primarily in investment grade securities, but may invest up to 20% of its total assets in junk bonds

rated B or higher by Moody's, or equivalently rated by S&P or Fitch, or, if unrated, determined by PIMCO to be of comparable quality.

1 1 1 1 0 0 1 1 2 8 8 10 10

MassMutual Premier High

$3,806.00 HY MPHZX 95.5/ 7.6/ 92.2/

Yield I 3.8 96.9 -0.61 14.0 13.0 HY HY HY HY

-95.3 5.7 98.8

The investment seeks to achieve a high level of total return, with an emphasis on current income, by investing primarily in high yield debt and related securities. The

fund invests primarily in lower rated U.S. debt securities, including securities in default. It invests at least 80% of its net assets (plus the amount of any borrowings for

Strategy Review

investment purposes) in lower rated fixed income securities (rated below Baa3 by Moody's, below BBB- by Standard & Poor's or the equivalent by any NRSRO (using

the lower rating) or, if unrated, determined to be of below investment grade quality by the fund's subadviser.

- - - -

SAGIC Core Bond $903,539.00 SV

- - - -

Strategy Review

1 1 1 1 1 1 1 1 2 10 10 10 10

Invesco Real Estate R5 $5,745.00 REI IARIX -78.3/ 15.6/ 92.3/

5.7 96.2 0.88 25.0 25.0 REI REI REI REI

93.3 5.0 78.2

The investment seeks total return through growth of capital and current income. The fund invests, under normal circumstances, at least 80% of its net assets (plus any

borrowings for investment purposes) in securities of real estate and real estate-related issuers, and in derivatives and other instruments that have economic

Strategy Review

characteristics similar to such securities. It may also invest in debt securities, including corporate debt obligations and commercial mortgage-backed securities. The

fund may invest up to 10% of its net assets in non-investment grade debt securities (commonly known as "junk bonds") of real estate and real estate-related issuers.

37