Page 123 - NovDefComp

P. 123

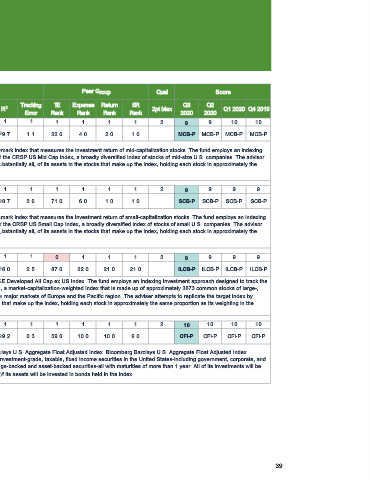

Scorecard - 401(a) Plan

Style Peer Group Qual Score

Asset Ticker/

Passive Assets

Class I D Style Tracking T E Expense Return S R Q3 Q2

Style R 2 2pt Max Q1 2020 Q4 2019

Drift Error Rank Rank Rank Rank 2020 2020

1 0 1 1 1 1 1 1 2 9 9 10 10

Vanguard Mid Cap Index

$34,334.00 MCB-P VMCIX -12.2/

Institutional 8.4 99.7 1.1 22.0 4.0 2.0 1.0 MCB-P MCB-P MCB-P MCB-P

5.1

The investment seeks to track the performance of a benchmark index that measures the investment return of mid-capitalization stocks. The fund employs an indexing

investment approach designed to track the performance of the CRSP US Mid Cap Index, a broadly diversified index of stocks of mid-size U.S. companies. The advisor

Strategy Review

attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the

same proportion as its weighting in the index.

1 0 1 1 1 1 1 1 2 9 9 9 9

Vanguard Small Cap

$56,279.00 SCB-P VSCIX 7.2/

Index I 21.5 98.7 2.6 71.0 6.0 1.0 1.0 SCB-P SCB-P SCB-P SCB-P

-57.1

The investment seeks to track the performance of a benchmark index that measures the investment return of small-capitalization stocks. The fund employs an indexing

investment approach designed to track the performance of the CRSP US Small Cap Index, a broadly diversified index of stocks of small U.S. companies. The advisor

Strategy Review

attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the

same proportion as its weighting in the index.

1 1 1 1 0 1 1 1 2 9 9 9 9

Vanguard Developed

$27,497.00 ILCB-P VDVIX -22.6/

Markets Index Inv 23.8 98.0 2.5 87.0 22.0 21.0 21.0 ILCB-P ILCB-P ILCB-P ILCB-P

18.5

The investment seeks to track the performance of the FTSE Developed All Cap ex US Index. The fund employs an indexing investment approach designed to track the

performance of the FTSE Developed All Cap ex US Index, a market-capitalization-weighted index that is made up of approximately 3873 common stocks of large-,

Strategy Review mid-, and small-cap companies located in Canada and the major markets of Europe and the Pacific region. The adviser attempts to replicate the target index by

investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the

index.

1 1 1 1 1 1 1 1 2 10 10 10 10

Vanguard Total Bond

$32,140.00 CFI-P VBTIX 16.1/

Market Index I 7.3 99.2 0.3 59.0 10.0 10.0 9.0 CFI-P CFI-P CFI-P CFI-P

71.0

The investment seeks the performance of Bloomberg Barclays U.S. Aggregate Float Adjusted Index. Bloomberg Barclays U.S. Aggregate Float Adjusted Index

measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States-including government, corporate, and

Strategy Review

international dollar-denominated bonds, as well as mortgage-backed and asset-backed securities-all with maturities of more than 1 year. All of its investments will be

selected through the sampling process, and at least 80% of its assets will be invested in bonds held in the index.

39