Page 85 - NovDefComp

P. 85

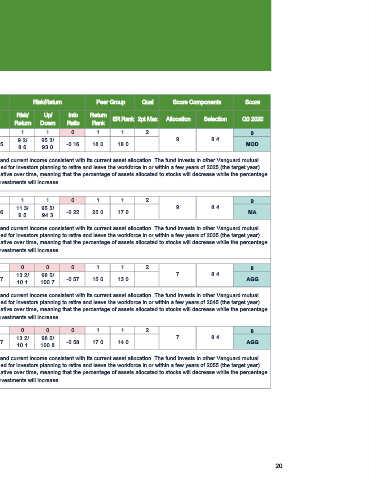

Scorecard - 457(b) Plan

continued

Style Risk/Return Peer Group Qual Score Components Score

Asset Ticker/

Asset Allocation Assets

Class I D Risk Style Risk/ Up/ Info Return

R 2 SR Rank 2pt Max Allocation Selection Q3 2020

Level Diversity Return Down Ratio Rank

Vanguard Target 1 1 1 1 1 0 1 1 2 9

Retirement 2025 Inv $37,213,196.00 MOD VTTVX 65.5/ 9.2/ 95.3/ 9 8.4

9.2 99.5 -0.16 18.0 18.0 MOD

(Default) 34.5 8.6 93.0

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in other Vanguard mutual

funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2025 (the target year).

Strategy Review

The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage

of assets allocated to bonds and other fixed income investments will increase.

Vanguard Target 1 1 1 1 1 0 1 1 2 9

Retirement 2035 Inv $30,956,061.00 M A VTTHX 80.4/ 11.3/ 95.5/ 9 8.4

11.3 99.6 -0.22 25.0 17.0 MA

(Default) 19.6 9.5 94.3

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in other Vanguard mutual

funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2035 (the target year).

Strategy Review

The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage

of assets allocated to bonds and other fixed income investments will increase.

Vanguard Target 1 1 1 0 0 0 1 1 2 8

Retirement 2045 Inv $26,162,000.00 AGG VTIVX 89.3/ 13.2/ 98.5/ 7 8.4

13.2 99.7 -0.57 15.0 13.0 AGG

(Default) 10.7 10.1 100.7

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in other Vanguard mutual

funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2045 (the target year).

Strategy Review

The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage

of assets allocated to bonds and other fixed income investments will increase.

Vanguard Target 1 1 1 0 0 0 1 1 2 8

Retirement 2055 Inv $17,455,396.00 AGG VFFVX 89.1/ 13.2/ 98.5/ 7 8.4

13.2 99.7 -0.58 17.0 14.0 AGG

(Default) 10.9 10.1 100.8

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in other Vanguard mutual

funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2055 (the target year).

Strategy Review

The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage

of assets allocated to bonds and other fixed income investments will increase.

20