Page 83 - NovDefComp

P. 83

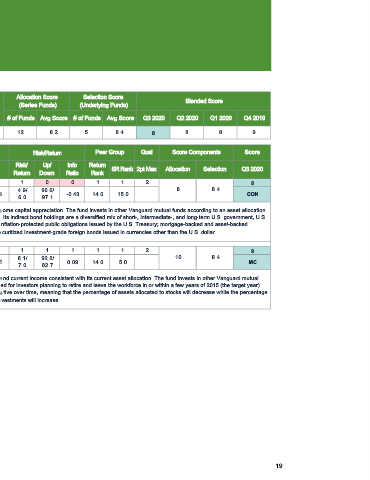

Scorecard - 457(b) Plan

Total Plan Assets: $555,723,755.00 as of 9/30/2020

Allocation Score Selection Score

Blended Score

Asset Risk (Series Funds) (Underlying Funds)

Asset Allocation Assets

Class Index

# of Funds Avg Score # of Funds Avg Score Q3 2020 Q2 2020 Q1 2020 Q4 2019

Vanguard Target Retirement Series Inv $130,794,688.00 AGG 85 12 8.2 5 8.4 8 8 8 9

Style Risk/Return Peer Group Qual Score Components Score

Asset Ticker/

Asset Allocation Assets

Class I D Risk Style 2 Risk/ Up/ Info Return

R SR Rank 2pt Max Allocation Selection Q3 2020

Level Diversity Return Down Ratio Rank

Vanguard Target 1 1 1 1 0 0 1 1 2 8

Retirement Income Inv $8,459,579.00 CON VTINX 30.7/ 4.9/ 96.6/ 8 8.4

4.9 98.8 -0.43 14.0 15.0 CON

(Default) 69.3 6.0 97.1

The investment seeks to provide current income and some capital appreciation. The fund invests in other Vanguard mutual funds according to an asset allocation

strategy designed for investors currently in retirement. Its indirect bond holdings are a diversified mix of short-, intermediate-, and long-term U.S. government, U.S.

Strategy Review

agency, and investment-grade U.S. corporate bonds; inflation-protected public obligations issued by the U.S. Treasury; mortgage-backed and asset-backed

securities; and government, agency, corporate, and securitized investment-grade foreign bonds issued in currencies other than the U.S. dollar.

Vanguard Target 1 1 1 1 1 1 1 1 2 9

Retirement 2015 Inv $10,548,456.00 MC VTXVX 46.0/ 6.1/ 92.2/ 10 8.4

6.1 98.5 0.09 14.0 5.0 MC

(Default) 54.0 7.0 82.7

The investment seeks to provide capital appreciation and current income consistent with its current asset allocation. The fund invests in other Vanguard mutual

funds according to an asset allocation strategy designed for investors planning to retire and leave the workforce in or within a few years of 2015 (the target year).

Strategy Review

The fund's asset allocation will become more conservative over time, meaning that the percentage of assets allocated to stocks will decrease while the percentage

of assets allocated to bonds and other fixed income investments will increase.

19