Page 93 - NovDefComp

P. 93

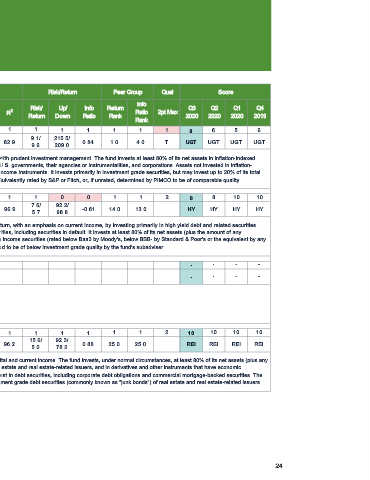

Scorecard - 457(b) Plan

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style Risk/ Up/ Info Return Q3 Q2 Q1 Q4

Style R 2 Ratio 2pt Max

Drift Return Down Ratio Rank 2020 2020 2020 2019

Rank

1 0 1 1 1 1 1 1 1 8 6 5 6

PIMCO Long-Term Real

$4,469,346.00 UGT PRAIX -50.4/ 9.1/ 215.5/

Return Instl 41.6 82.9 0.84 1.0 4.0 T UGT UGT UGT UGT

89.5 9.6 209.0

The investment seeks maximum real return, consistent with prudent investment management. The fund invests at least 80% of its net assets in inflation-indexed

bonds of varying maturities issued by the U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations. Assets not invested in inflation-

Strategy Review

indexed bonds may be invested in other types of Fixed Income Instruments. It invests primarily in investment grade securities, but may invest up to 20% of its total

assets in junk bonds rated B or higher by Moody's, or equivalently rated by S&P or Fitch, or, if unrated, determined by PIMCO to be of comparable quality.

1 1 1 1 0 0 1 1 2 8 8 10 10

MassMutual Premier High

$782,678.00 HY MPHZX 95.5/ 7.6/ 92.2/

Yield I 3.8 96.9 -0.61 14.0 13.0 HY HY HY HY

-95.3 5.7 98.8

The investment seeks to achieve a high level of total return, with an emphasis on current income, by investing primarily in high yield debt and related securities.

The fund invests primarily in lower rated U.S. debt securities, including securities in default. It invests at least 80% of its net assets (plus the amount of any

Strategy Review

borrowings for investment purposes) in lower rated fixed income securities (rated below Baa3 by Moody's, below BBB- by Standard & Poor's or the equivalent by any

NRSRO (using the lower rating) or, if unrated, determined to be of below investment grade quality by the fund's subadviser.

- - - -

SAGIC Core Bond $152,072,201.00 SV

- - - -

Strategy Review

1 1 1 1 1 1 1 1 2 10 10 10 10

Invesco Real Estate R5 $2,474,458.00 REI IARIX -78.3/ 15.6/ 92.3/

5.7 96.2 0.88 25.0 25.0 REI REI REI REI

93.3 5.0 78.2

The investment seeks total return through growth of capital and current income. The fund invests, under normal circumstances, at least 80% of its net assets (plus any

borrowings for investment purposes) in securities of real estate and real estate-related issuers, and in derivatives and other instruments that have economic

Strategy Review

characteristics similar to such securities. It may also invest in debt securities, including corporate debt obligations and commercial mortgage-backed securities. The

fund may invest up to 10% of its net assets in non-investment grade debt securities (commonly known as "junk bonds") of real estate and real estate-related issuers.

24