Page 94 - NovDefComp

P. 94

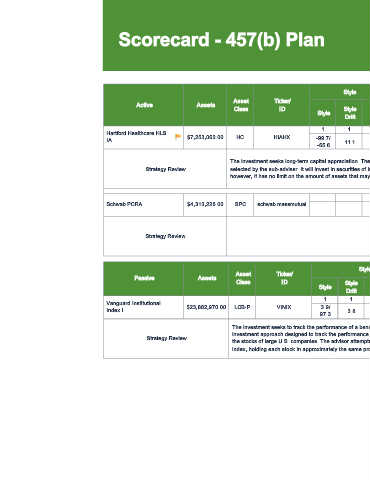

Scorecard - 457(b) Plan

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style Risk/ Up/ Info Return Q3

Style R 2 Ratio 2pt Max Q2 2020 Q1 2020 Q4 2019

Drift Return Down Ratio Rank 2020

Rank

1 1 1 1 0 1 0 0 2 7 6 7 7

Hartford Healthcare HLS

$7,253,062.00 HC HIAHX -99.7/ 17.2/ 108.5/

IA 11.1 86.8 0.07 54.0 54.0 HC HC HC HC

-65.6 12.6 109.7

The investment seeks long-term capital appreciation. The fund invests at least 80% of its assets in the equity securities of health care-related companies worldwide as

Strategy Review selected by the sub-adviser. It will invest in securities of issuers located in a number of different countries throughout the world, one of which may be the United States;

however, it has no limit on the amount of assets that may be invested in each country. The fund may invest in securities of companies of any market capitalization.

- - - -

Schwab PCRA $4,313,228.00 SPC schwab.massmutual

- - - -

Strategy Review

Style Peer Group Qual Score

Asset Ticker/

Passive Assets

Class I D Style Tracking T E Expense Return S R Q3 Q2 Q1

Style R 2 2pt Max Q4 2019

Drift Error Rank Rank Rank Rank 2020 2020 2020

1 1 1 1 1 1 1 1 2 10 10 10 10

Vanguard Institutional

$23,882,970.00 LCB-P VINIX 3.9/

Index I 3.8 99.9 0.8 39.0 11.0 18.0 17.0 LCB-P LCB-P LCB-P LCB-P

97.3

The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing

investment approach designed to track the performance of the S&P 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by

Strategy Review

the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the

index, holding each stock in approximately the same proportion as its weighting in the index.

25