Page 28 - DecDefComp

P. 28

Source: Bloomberg, FactSet, Federal

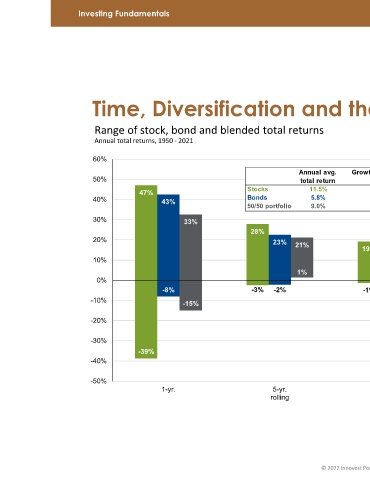

Time, Diversification and the Volatility of Returns

Annual avg. Reserve, Robert Shiller, Strategas/Ibbotson, Growth of $100,000 over J.P. Morgan Asset Management. 20 years total return Returns shown are based on calendar year $880,148 11.5% returns from 1950 to 2021. Stocks represent $308,786 5.8% the S&P 500 Shiller Composite and Bonds $562,115 9.0% represent Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2021. Guide to the Markets –U.S. Data are as of 21% 19% October 13, 2022. 17% 16%

Range of stock, bond and blended total returns

50/50 portfolio 23% -2% 5-yr. rolling

Stocks Bonds 28% -3%

2021 43% 33% -8% -15% 1-yr.

Investing Fundamentals Annual total returns, 1950 ‐ 60% 50% 47% 40% 30% 20% 10% 0% -10% -20% -30% -39% -40% -50%