Page 29 - DecDefComp

P. 29

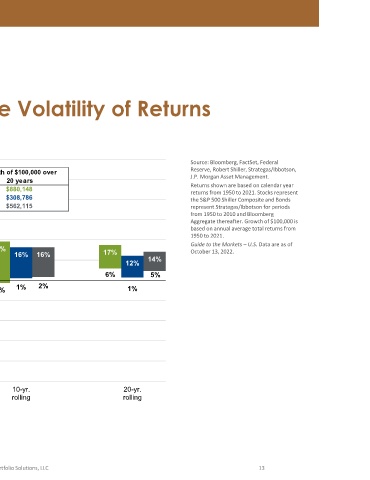

Source: Bloomberg, FactSet, Federal Reserve, Robert Shiller, Strategas/Ibbotson, J.P. Morgan Asset Management. Returns shown are based on calendar year returns from 1950 to 2021. Stocks represent the S&P 500 Shiller Composite and Bonds represent Strategas/Ibbotson for periods from 1950 to 2010 and Bloomberg Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2021. Guide to the Markets –U.S. Data are as of October 13, 2022. 13

Time, Diversification and the Volatility of Returns

14% 5%

12% 1% 20-yr. rolling

17% 6%

Growth of $100,000 over 20 years $880,148 $308,786 $562,115 19% 16% 16% 2% 1% -1% 10-yr. rolling © 2022 Innovest Portfolio Solutions, LLC

Annual avg. total return 11.5% 5.8% 9.0% 21% 1%

Range of stock, bond and blended total returns

50/50 portfolio 23% -2% 5-yr. rolling

Stocks Bonds 28% -3%

2021 43% 33% -8% -15% 1-yr.

Investing Fundamentals Annual total returns, 1950 ‐ 60% 50% 47% 40% 30% 20% 10% 0% -10% -20% -30% -39% -40% -50%