Page 88 - DCAC February 2024 Files

P. 88

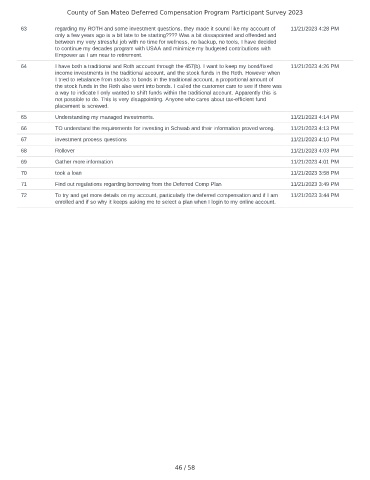

County of San Mateo Deferred Compensation Program Participant Survey 2023

63 regarding my ROTH and some investment questions, they made it sound like my account of 11/21/2023 4:28 PM

only a few years ago is a bit late to be starting???? Was a bit dissapointed and offended and

between my very stressful job with no time for wellness, no backup, no tools, I have decided

to continue my decades program with USAA and minimize my budgeted contributions with

Empower as I am near to retirement.

64 I have both a traditional and Roth account through the 457(b). I want to keep my bond/fixed 11/21/2023 4:26 PM

income investments in the traditional account, and the stock funds in the Roth. However when

I tried to rebalance from stocks to bonds in the traditional account, a proportional amount of

the stock funds in the Roth also went into bonds. I called the customer care to see if there was

a way to indicate I only wanted to shift funds within the traditional account. Apparently this is

not possible to do. This is very disappointing. Anyone who cares about tax-efficient fund

placement is screwed.

65 Understanding my managed investments. 11/21/2023 4:14 PM

66 TO understand the requirements for investing in Schwab and their information proved wrong. 11/21/2023 4:13 PM

67 investment process questions 11/21/2023 4:10 PM

68 Rollover 11/21/2023 4:03 PM

69 Gather more information 11/21/2023 4:01 PM

70 took a loan 11/21/2023 3:58 PM

71 Find out regulations regarding borrowing from the Deferred Comp Plan 11/21/2023 3:49 PM

72 To try and get more details on my account, particularly the deferred compensation and if I am 11/21/2023 3:44 PM

enrolled and if so why it keeps asking me to select a plan when I login to my online account.

46 / 58