Page 124 - AugDefComp

P. 124

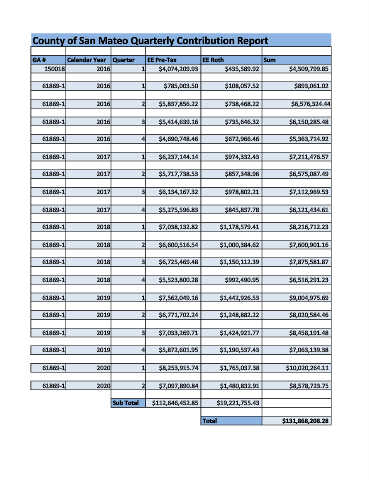

County of San Mateo Quarterly Contribution Report

GA # Calendar Year Quarter EE Pre-Tax EE Roth Sum

150018 2016 1 $4,074,209.93 $435,589.92 $4,509,799.85

61869-1 2016 1 $785,003.50 $108,057.52 $893,061.02

61869-1 2016 2 $5,837,856.22 $738,468.22 $6,576,324.44

61869-1 2016 3 $5,414,639.16 $735,646.32 $6,150,285.48

61869-1 2016 4 $4,690,748.46 $672,966.46 $5,363,714.92

61869-1 2017 1 $6,237,144.14 $974,332.43 $7,211,476.57

61869-1 2017 2 $5,717,738.53 $857,348.96 $6,575,087.49

61869-1 2017 3 $6,134,167.32 $978,802.21 $7,112,969.53

61869-1 2017 4 $5,275,596.83 $845,837.78 $6,121,434.61

61869-1 2018 1 $7,038,132.82 $1,178,579.41 $8,216,712.23

61869-1 2018 2 $6,600,516.54 $1,000,384.62 $7,600,901.16

61869-1 2018 3 $6,725,469.48 $1,150,112.39 $7,875,581.87

61869-1 2018 4 $5,523,800.28 $992,490.95 $6,516,291.23

61869-1 2019 1 $7,562,049.16 $1,442,926.53 $9,004,975.69

61869-1 2019 2 $6,771,702.24 $1,248,882.22 $8,020,584.46

61869-1 2019 3 $7,033,269.71 $1,424,921.77 $8,458,191.48

61869-1 2019 4 $5,872,601.95 $1,190,537.43 $7,063,139.38

61869-1 2020 1 $8,253,915.74 $1,765,037.38 $10,020,264.11

61869-1 2020 2 $7,097,890.84 $1,480,832.91 $8,578,723.75

Sub Total $112,646,452.85 $19,221,755.43

Total $131,868,208.28