Page 37 - AugDefComp

P. 37

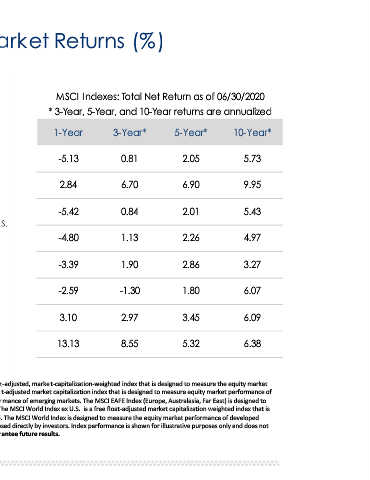

* 3-Year, 5-Year, and 10-Year returns are annualized

10-Year* 5.73 9.95 5.43 4.97 3.27 6.07 6.09 6.38

MSCI Indexes: Total Net Return as of 06/30/2020

5-Year* 2.05 6.90 2.01 2.26 2.86 1.80 3.45 5.32 EAFE Index (Europe, Australasia, Far East) is designed to free float‐adjusted market capitalization weighted index that is measure the equity market performance of developed

Global Equity Market Returns (%)

3-Year* 0.81 6.70 0.84 1.13 1.90 -1.30 2.97 8.55

to

1-Year -5.13 2.84 -5.42 -4.80 -3.39 -2.59 3.10 13.13 Source: Morningstar Direct, 06/30/2020. The MSCI All Country World Index (ACWI) is a free‐float‐adjusted, market‐capitalization‐weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI Frontier Markets Index is a free float‐adjusted market capitalization index that is designed to measure equity market performance of frontier markets. The MSCI Emerging Markets Index is designed to measure equity market performance of emerging markets. The

as of 06/30/2020 measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI World Index ex U.S. is a designed to measure the equity market performance of developed markets and excludes the U.S. The MSCI World Index is designed markets. predict or depict the performance of any particular investment. Past performance does not guarantee future results.