Page 33 - AugDefComp

P. 33

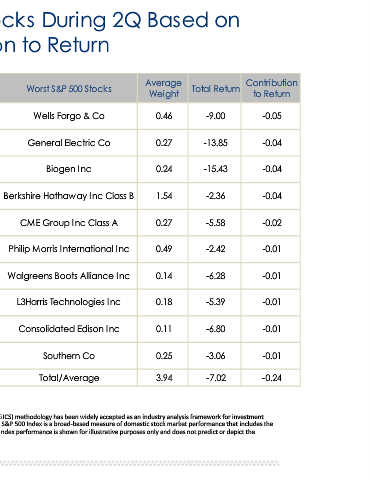

Contribution to Return -0.05 -0.04 -0.04 -0.04 -0.02 -0.01 -0.01 -0.01 -0.01 -0.01 -0.24

Best & Worst S&P 500 Stocks During 2Q Based on

Total Return -9.00 -13.85 -15.43 -2.36 -5.58 -2.42 -6.28 -5.39 -6.80 -3.06 -7.02

Average Weight 0.46 0.27 0.24 1.54 0.27 0.49 0.14 0.18 0.11 0.25 3.94 widely accepted as an industry analysis framework for investment

Worst S&P 500 Stocks Wells Fargo & Co General Electric Co Biogen Inc Berkshire Hathaway Inc Class B CME Group Inc Class A Philip Morris International Inc Walgreens Boots Alliance Inc L3Harris Technologies Inc Consolidated Edison Inc Southern Co Total/Average

Contribution to Return

Contribution to Return 2.17 1.65 1.57 0.68 0.43 0.36 0.35 0.33 0.33 0.27 8.15 research, portfolio management and asset allocation. The GICS structure consists of 10 sectors. The S&P 500 Index is a broad‐based measure of domestic stock market performance that includes the reinvestment of dividends. The index is unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the

Total Return 43.84 29.40 41.50 36.13 81.98 22.04 21.57 44.19 34.97 36.79 39.24 Source of chart data: Morningstar Direct, 06/30/2020. The Global Industry Classification Standard (GICS) methodology has been

Average Weight 5.10 5.61 4.03 2.02 0.61 1.67 1.66 0.78 1.01 0.72 23.22 The mention of specific companies does not constitute a recommendation. performance of any particular investment. Past performance does not guarantee future results.

as of 06/30/2020 Best S&P 500 Stocks Apple Inc Microsoft Corp Amazon.com Inc Facebook Inc A PayPal Holdings Inc Alphabet Inc A Alphabet Inc Class C NVIDIA Corp The Home Depot Inc Adobe Inc Total/Average