Page 18 - AugDefComp

P. 18

Market Overview 6/30/2021

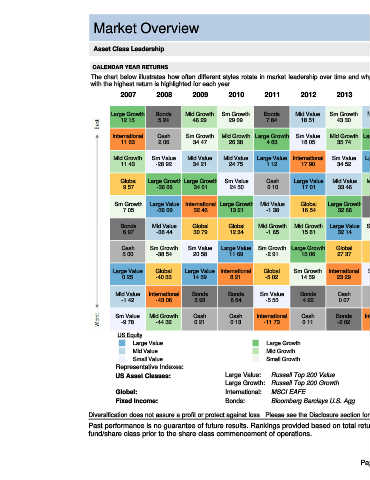

Asset Class Leadership

CALENDAR YEAR RETURNS

The chart below illustrates how often different styles rotate in market leadership over time and why style diversification may help to minimize overall portfolio volatility. In the chart below, the style

with the highest return is highlighted for each year.

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD

Large Growth Bonds Mid Growth Sm Growth Bonds Mid Value Sm Growth Mid Value Large Growth Sm Value Large Growth Cash Large Growth International Sm Value

12.15 5.24 46.29 29.09 7.84 18.51 43.30 14.75 8.18 31.74 31.92 1.87 36.48 8.28 26.69

International Cash Sm Growth Mid Growth Large Growth Sm Value Mid Growth Large Growth Bonds Mid Value International Bonds Mid Growth Bonds Mid Value

11.63 2.06 34.47 26.38 4.63 18.05 35.74 13.57 0.55 20.00 25.62 0.01 35.47 7.51 19.45

Mid Growth Sm Value Mid Value Mid Value Large Value International Sm Value Large Value Cash Large Value Mid Growth Large Growth Sm Growth Mid Value Large Value

11.43 -28.92 34.21 24.75 1.12 17.90 34.52 12.94 0.05 16.20 25.27 -0.52 28.48 4.96 15.76

Global Large Growth Large Growth Sm Value Cash Large Value Mid Value Mid Growth Mid Growth Sm Growth Global Mid Growth Global Sm Value Large Growth

9.57 -36.06 34.01 24.50 0.10 17.01 33.46 11.90 -0.20 11.32 23.07 -4.75 28.40 4.63 13.59

Sm Growth Large Value International Large Growth Mid Value Global Large Growth Bonds Global Global Sm Growth Large Value Mid Value Large Growth Global

7.05 -36.09 32.46 13.21 -1.38 16.54 32.66 5.97 -0.32 8.15 22.17 -6.22 27.06 39.34 13.33

Bonds Mid Value Global Global Mid Growth Mid Growth Large Value Sm Growth International Mid Growth Large Value Global Large Value Mid Growth Mid Growth

6.97 -38.44 30.79 12.34 -1.65 15.81 32.14 5.60 -0.39 7.33 13.83 -8.20 26.36 35.59 10.44

Cash Sm Growth Sm Value Large Value Sm Growth Large Growth Global Global Sm Growth Large Growth Mid Value Sm Growth International Sm Growth International

5.00 -38.54 20.58 11.69 -2.91 15.06 27.37 5.50 -1.38 6.95 13.34 -9.31 22.66 34.63 9.17

Large Value Global Large Value International Global Sm Growth International Sm Value Large Value Bonds Sm Value Mid Value Sm Value Global Sm Growth

0.25 -40.33 14.59 8.21 -5.02 14.59 23.29 4.22 -3.41 2.65 7.84 -12.29 22.39 16.50 8.98

Mid Value International Bonds Bonds Sm Value Bonds Cash Cash Mid Value International Bonds Sm Value Bonds Large Value Cash

-1.42 -43.06 5.93 6.54 -5.50 4.22 0.07 0.03 -4.78 1.51 3.54 -12.86 8.72 1.64 0.02

Sm Value Mid Growth Cash Cash International Cash Bonds International Sm Value Cash Cash International Cash Cash Bonds

-9.78 -44.32 0.21 0.13 -11.73 0.11 -2.02 -4.48 -7.47 0.33 0.86 -13.36 2.28 0.67 -1.60

US Equity Fixed Income Global Equity

Large Value Large Growth Bonds International

Mid Value Mid Growth Cash Global

Small Value Small Growth

Representative Indexes:

US Asset Classes: Large Value: Russell Top 200 Value Mid Value: Russell Mid-Cap Value Sm Value: Russell 2000 Value

Large Growth: Russell Top 200 Growth Mid Growth: Russell Mid-Cap Growth Sm Growth: Russell 2000 Growth

Global: International: MSCI EAFE Global: MSCI The World

Fixed Income: Bonds: Bloomberg Barclays U.S. Agg Cash: Merrill Lynch 3-Mo T-Bill

Diversification does not assure a profit or protect against loss. Please see the Disclosure section for definition of all indices discussed.

Past performance is no guarantee of future results. Rankings provided based on total returns. Performance quoted for mutual funds may include performance of a predecessor

fund/share class prior to the share class commencement of operations.

Page 3