Page 20 - AugDefComp

P. 20

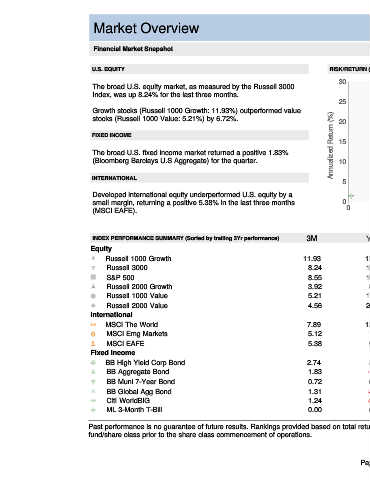

Market Overview 6/30/2021

Financial Market Snapshot

U.S. EQUITY RISK/RETURN (3-Year)

30

The broad U.S. equity market, as measured by the Russell 3000

Index, was up 8.24% for the last three months.

25

Growth stocks (Russell 1000 Growth: 11.93%) outperformed value

Annualized Return (%) 15

stocks (Russell 1000 Value: 5.21%) by 6.72%. 20

FIXED INCOME

The broad U.S. fixed income market returned a positive 1.83%

(Bloomberg Barclays U.S Aggregate) for the quarter. 10

INTERNATIONAL

5

Developed international equity underperformed U.S. equity by a

small margin, returning a positive 5.38% in the last three months 0

(MSCI EAFE). 0 5 10 15 20 25 30

Annualized Standard Deviation (%)

INDEX PERFORMANCE SUMMARY (Sorted by trailing 3Yr performance) 3M YTD 1 Year 3 Years 5 Years 10 Years

Equity

Russell 1000 Growth 11.93 12.99 42.50 25.14 23.66 17.87

Russell 3000 8.24 15.11 44.16 18.73 17.89 14.70

S&P 500 8.55 15.25 40.79 18.67 17.65 14.84

Russell 2000 Growth 3.92 8.98 51.36 15.94 18.76 13.52

Russell 1000 Value 5.21 17.05 43.68 12.42 11.87 11.61

Russell 2000 Value 4.56 26.69 73.28 10.27 13.62 10.85

International

MSCI The World 7.89 13.33 39.67 15.59 15.44 11.26

MSCI Emg Markets 5.12 7.58 41.36 11.67 13.43 4.65

MSCI EAFE 5.38 9.17 32.92 8.77 10.79 6.38

Fixed Income

BB High Yield Corp Bond 2.74 3.62 15.37 7.45 7.48 6.66

BB Aggregate Bond 1.83 -1.60 -0.33 5.34 3.03 3.39

BB Muni 7-Year Bond 0.72 0.18 2.95 4.63 2.85 3.59

BB Global Agg Bond 1.31 -3.21 2.63 4.23 2.34 2.05

Citi WorldBIG 1.24 -3.51 1.95 4.20 2.40 2.09

ML 3-Month T-Bill 0.00 0.02 0.09 1.34 1.17 0.63

Past performance is no guarantee of future results. Rankings provided based on total returns. Performance quoted for mutual funds may include performance of a predecessor

fund/share class prior to the share class commencement of operations.

Page 4