Page 22 - AugDefComp

P. 22

Market Overview 6/30/2021

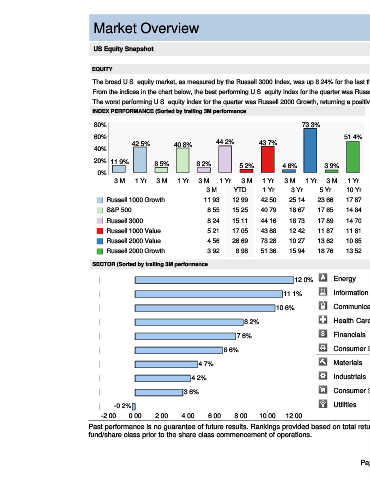

US Equity Snapshot

EQUITY

The broad U.S. equity market, as measured by the Russell 3000 Index, was up 8.24% for the last three months.

From the indices in the chart below, the best performing U.S. equity index for the quarter was Russell 1000 Growth, returning a positive 11.93%.

The worst performing U.S. equity index for the quarter was Russell 2000 Growth, returning a positive 3.92%

INDEX PERFORMANCE (Sorted by trailing 3M performance) GROWTH VS. VALUE

80% 73.3% 50% Growth Outperforms

40%

60% 51.4% 30%

42.5% 40.8% 44.2% 43.7% 20%

40%

10%

0%

20% 11.9% 8.5% 8.2% 5.2% 4.6% 3.9% 10%

0% 20% Value Outperforms

3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 3 M 1 Yr 7/09 12/10 12/11 12/12 12/13 12/14 12/15 12/16 12/17 12/18 12/19 6/21

3 M YTD 1 Yr 3 Yr 5 Yr 10 Yr

Within the last 1 Year, value stocks outperformed growth stocks by 1.18%.

Russell 1000 Growth 11.93 12.99 42.50 25.14 23.66 17.87 For the trailing 3 months, growth stocks outperformed value stocks by 6.72%.

S&P 500 8.55 15.25 40.79 18.67 17.65 14.84

The graph above is plotted using a rolling one year time period. Growth stock performance

Russell 3000 8.24 15.11 44.16 18.73 17.89 14.70 is represented by the Russell 1000 Growth Index. Value stock performance is represented

Russell 1000 Value 5.21 17.05 43.68 12.42 11.87 11.61 by the Russell 1000 Value Index.

Russell 2000 Value 4.56 26.69 73.28 10.27 13.62 10.85

Russell 2000 Growth 3.92 8.98 51.36 15.94 18.76 13.52

SECTOR (Sorted by trailing 3M performance) 3 M YTD 1 Yr 3 Yr 5 Yr 10 Yr

12.0% Energy 11.97 47.15 52.70 -6.97 -1.37 -0.71

11.1% Information Technology 11.13 13.66 43.16 29.84 30.68 21.48

10.6% Communication Svcs. 10.56 19.56 48.21 23.03 10.79 11.22

8.2% Health Care 8.17 11.81 28.88 16.95 14.52 15.91

7.6% Financials 7.60 25.16 61.15 13.19 16.43 13.53

6.6% Consumer Discretionary 6.61 12.27 41.57 19.38 19.51 17.50

4.7% Materials 4.71 15.81 51.16 14.01 14.39 10.28

4.2% Industrials 4.19 16.63 52.57 15.12 14.91 13.04

3.6% Consumer Staples 3.61 5.52 24.15 14.07 8.09 11.55

-0.2% Utilities -0.21 3.17 16.20 9.83 7.33 10.63

-2.00 0.00 2.00 4.00 6.00 8.00 10.00 12.00 Source: S&P 1500 Sector Indices.

Past performance is no guarantee of future results. Rankings provided based on total returns. Performance quoted for mutual funds may include performance of a predecessor

fund/share class prior to the share class commencement of operations.

Page 5