Page 154 - FebDefComp

P. 154

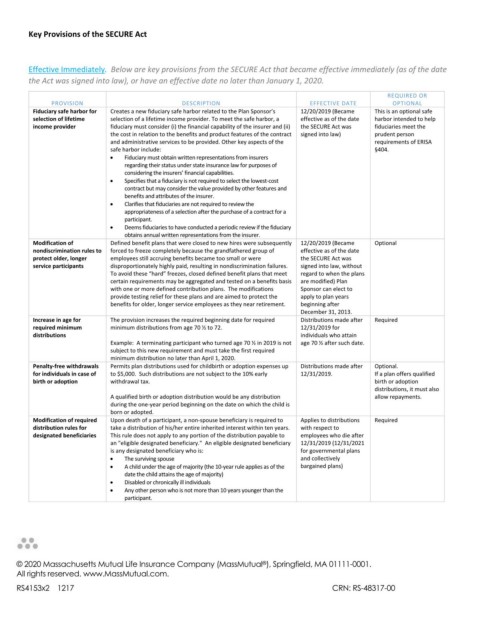

Key Provisions of the SECURE Act

Effective Immediately. Below are key provisions from the SECURE Act that became effective immediately (as of the date

the Act was signed into law), or have an effective date no later than January 1, 2020.

REQUIRED OR

PROVISION DESCRIPTION EFFECTIVE DATE OPTIONAL

Fiduciary safe harbor for Creates a new fiduciary safe harbor related to the Plan Sponsor’s 12/20/2019 (Became This is an optional safe

selection of lifetime selection of a lifetime income provider. To meet the safe harbor, a effective as of the date harbor intended to help

income provider fiduciary must consider (i) the financial capability of the insurer and (ii) the SECURE Act was fiduciaries meet the

the cost in relation to the benefits and product features of the contract signed into law) prudent person

and administrative services to be provided. Other key aspects of the requirements of ERISA

safe harbor include: §404.

Fiduciary must obtain written representations from insurers

regarding their status under state insurance law for purposes of

considering the insurers’ financial capabilities.

Specifies that a fiduciary is not required to select the lowest‐cost

contract but may consider the value provided by other features and

benefits and attributes of the insurer.

Clarifies that fiduciaries are not required to review the

appropriateness of a selection after the purchase of a contract for a

participant.

Deems fiduciaries to have conducted a periodic review if the fiduciary

obtains annual written representations from the insurer.

Modification of Defined benefit plans that were closed to new hires were subsequently 12/20/2019 (Became Optional

nondiscrimination rules to forced to freeze completely because the grandfathered group of effective as of the date

protect older, longer employees still accruing benefits became too small or were the SECURE Act was

service participants disproportionately highly paid, resulting in nondiscrimination failures. signed into law, without

To avoid these “hard” freezes, closed defined benefit plans that meet regard to when the plans

certain requirements may be aggregated and tested on a benefits basis are modified) Plan

with one or more defined contribution plans. The modifications Sponsor can elect to

provide testing relief for these plans and are aimed to protect the apply to plan years

benefits for older, longer service employees as they near retirement. beginning after

December 31, 2013.

Increase in age for The provision increases the required beginning date for required Distributions made after Required

required minimum minimum distributions from age 70 ½ to 72. 12/31/2019 for

distributions individuals who attain

Example: A terminating participant who turned age 70 ½ in 2019 is not age 70 ½ after such date.

subject to this new requirement and must take the first required

minimum distribution no later than April 1, 2020.

Penalty‐free withdrawals Permits plan distributions used for childbirth or adoption expenses up Distributions made after Optional.

for individuals in case of to $5,000. Such distributions are not subject to the 10% early 12/31/2019. If a plan offers qualified

birth or adoption withdrawal tax. birth or adoption

distributions, it must also

A qualified birth or adoption distribution would be any distribution allow repayments.

during the one‐year period beginning on the date on which the child is

born or adopted.

Modification of required Upon death of a participant, a non‐spouse beneficiary is required to Applies to distributions Required

distribution rules for take a distribution of his/her entire inherited interest within ten years. with respect to

designated beneficiaries This rule does not apply to any portion of the distribution payable to employees who die after

an "eligible designated beneficiary." An eligible designated beneficiary 12/31/2019 (12/31/2021

is any designated beneficiary who is: for governmental plans

The surviving spouse and collectively

A child under the age of majority (the 10‐year rule applies as of the bargained plans)

date the child attains the age of majority)

Disabled or chronically ill individuals

Any other person who is not more than 10 years younger than the

participant.

© 2020 Massachusetts Mutual Life Insurance Company (MassMutual ), Springfield, MA 01111-0001.

®

All rights reserved. www.MassMutual.com.

RS4153x2 1217 CRN: RS-48317-00