Page 156 - FebDefComp

P. 156

REQUIRED OR

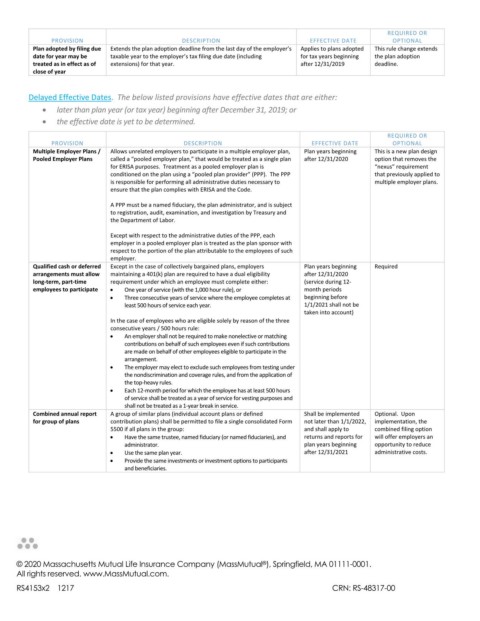

PROVISION DESCRIPTION EFFECTIVE DATE OPTIONAL

Plan adopted by filing due Extends the plan adoption deadline from the last day of the employer’s Applies to plans adopted This rule change extends

date for year may be taxable year to the employer’s tax filing due date (including for tax years beginning the plan adoption

treated as in effect as of extensions) for that year. after 12/31/2019 deadline.

close of year

Delayed Effective Dates. The below listed provisions have effective dates that are either:

later than plan year (or tax year) beginning after December 31, 2019; or

the effective date is yet to be determined.

REQUIRED OR

PROVISION DESCRIPTION EFFECTIVE DATE OPTIONAL

Multiple Employer Plans / Allows unrelated employers to participate in a multiple employer plan, Plan years beginning This is a new plan design

Pooled Employer Plans called a “pooled employer plan,” that would be treated as a single plan after 12/31/2020 option that removes the

for ERISA purposes. Treatment as a pooled employer plan is “nexus” requirement

conditioned on the plan using a “pooled plan provider” (PPP). The PPP that previously applied to

is responsible for performing all administrative duties necessary to multiple employer plans.

ensure that the plan complies with ERISA and the Code.

A PPP must be a named fiduciary, the plan administrator, and is subject

to registration, audit, examination, and investigation by Treasury and

the Department of Labor.

Except with respect to the administrative duties of the PPP, each

employer in a pooled employer plan is treated as the plan sponsor with

respect to the portion of the plan attributable to the employees of such

employer.

Qualified cash or deferred Except in the case of collectively bargained plans, employers Plan years beginning Required

arrangements must allow maintaining a 401(k) plan are required to have a dual eligibility after 12/31/2020

long‐term, part‐time requirement under which an employee must complete either: (service during 12‐

employees to participate One year of service (with the 1,000 hour rule), or month periods

Three consecutive years of service where the employee completes at beginning before

least 500 hours of service each year. 1/1/2021 shall not be

taken into account)

In the case of employees who are eligible solely by reason of the three

consecutive years / 500 hours rule:

An employer shall not be required to make nonelective or matching

contributions on behalf of such employees even if such contributions

are made on behalf of other employees eligible to participate in the

arrangement.

The employer may elect to exclude such employees from testing under

the nondiscrimination and coverage rules, and from the application of

the top‐heavy rules.

Each 12‐month period for which the employee has at least 500 hours

of service shall be treated as a year of service for vesting purposes and

shall not be treated as a 1‐year break in service.

Combined annual report A group of similar plans (individual account plans or defined Shall be implemented Optional. Upon

for group of plans contribution plans) shall be permitted to file a single consolidated Form not later than 1/1/2022, implementation, the

5500 if all plans in the group: and shall apply to combined filing option

Have the same trustee, named fiduciary (or named fiduciaries), and returns and reports for will offer employers an

administrator. plan years beginning opportunity to reduce

Use the same plan year. after 12/31/2021 administrative costs.

Provide the same investments or investment options to participants

and beneficiaries.

© 2020 Massachusetts Mutual Life Insurance Company (MassMutual ), Springfield, MA 01111-0001.

®

All rights reserved. www.MassMutual.com.

RS4153x2 1217 CRN: RS-48317-00