Page 155 - FebDefComp

P. 155

REQUIRED OR

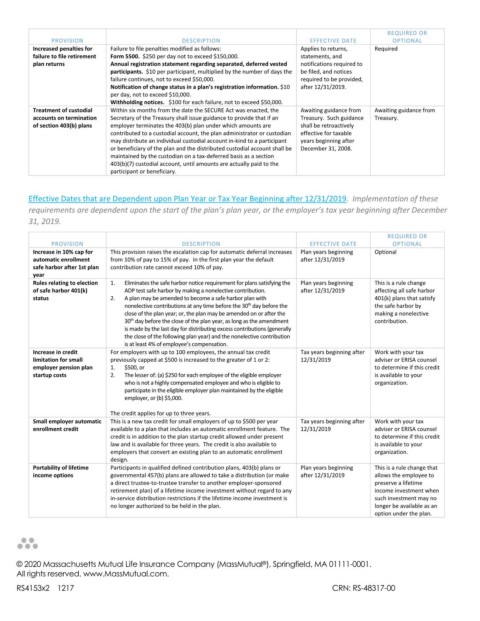

PROVISION DESCRIPTION EFFECTIVE DATE OPTIONAL

Increased penalties for Failure to file penalties modified as follows: Applies to returns, Required

failure to file retirement Form 5500. $250 per day not to exceed $150,000. statements, and

plan returns Annual registration statement regarding separated, deferred vested notifications required to

participants. $10 per participant, multiplied by the number of days the be filed, and notices

failure continues, not to exceed $50,000. required to be provided,

Notification of change status in a plan’s registration information. $10 after 12/31/2019.

per day, not to exceed $10,000.

Withholding notices. $100 for each failure, not to exceed $50,000.

Treatment of custodial Within six months from the date the SECURE Act was enacted, the Awaiting guidance from Awaiting guidance from

accounts on termination Secretary of the Treasury shall issue guidance to provide that if an Treasury. Such guidance Treasury.

of section 403(b) plans employer terminates the 403(b) plan under which amounts are shall be retroactively

contributed to a custodial account, the plan administrator or custodian effective for taxable

may distribute an individual custodial account in‐kind to a participant years beginning after

or beneficiary of the plan and the distributed custodial account shall be December 31, 2008.

maintained by the custodian on a tax‐deferred basis as a section

403(b)(7) custodial account, until amounts are actually paid to the

participant or beneficiary.

Effective Dates that are Dependent upon Plan Year or Tax Year Beginning after 12/31/2019. Implementation of these

requirements are dependent upon the start of the plan’s plan year, or the employer’s tax year beginning after December

31, 2019.

REQUIRED OR

PROVISION DESCRIPTION EFFECTIVE DATE OPTIONAL

Increase in 10% cap for This provision raises the escalation cap for automatic deferral increases Plan years beginning Optional

automatic enrollment from 10% of pay to 15% of pay. In the first plan year the default after 12/31/2019

safe harbor after 1st plan contribution rate cannot exceed 10% of pay.

year

Rules relating to election 1. Eliminates the safe harbor notice requirement for plans satisfying the Plan years beginning This is a rule change

of safe harbor 401(k) ADP test safe harbor by making a nonelective contribution. after 12/31/2019 affecting all safe harbor

status 2. A plan may be amended to become a safe harbor plan with 401(k) plans that satisfy

th

nonelective contributions at any time before the 30 day before the the safe harbor by

close of the plan year; or, the plan may be amended on or after the making a nonelective

th

30 day before the close of the plan year, as long as the amendment contribution.

is made by the last day for distributing excess contributions (generally

the close of the following plan year) and the nonelective contribution

is at least 4% of employee’s compensation.

Increase in credit For employers with up to 100 employees, the annual tax credit Tax years beginning after Work with your tax

limitation for small previously capped at $500 is increased to the greater of 1 or 2: 12/31/2019 adviser or ERISA counsel

employer pension plan 1. $500, or to determine if this credit

startup costs 2. The lesser of: (a) $250 for each employee of the eligible employer is available to your

who is not a highly compensated employee and who is eligible to organization.

participate in the eligible employer plan maintained by the eligible

employer, or (b) $5,000.

The credit applies for up to three years.

Small employer automatic This is a new tax credit for small employers of up to $500 per year Tax years beginning after Work with your tax

enrollment credit available to a plan that includes an automatic enrollment feature. The 12/31/2019 adviser or ERISA counsel

credit is in addition to the plan startup credit allowed under present to determine if this credit

law and is available for three years. The credit is also available to is available to your

employers that convert an existing plan to an automatic enrollment organization.

design.

Portability of lifetime Participants in qualified defined contribution plans, 403(b) plans or Plan years beginning This is a rule change that

income options governmental 457(b) plans are allowed to take a distribution (or make after 12/31/2019 allows the employee to

a direct trustee‐to‐trustee transfer to another employer‐sponsored preserve a lifetime

retirement plan) of a lifetime income investment without regard to any income investment when

in‐service distribution restrictions if the lifetime income investment is such investment may no

no longer authorized to be held in the plan. longer be available as an

option under the plan.

© 2020 Massachusetts Mutual Life Insurance Company (MassMutual ), Springfield, MA 01111-0001.

®

All rights reserved. www.MassMutual.com.

RS4153x2 1217 CRN: RS-48317-00