Page 44 - FebDefComp

P. 44

14

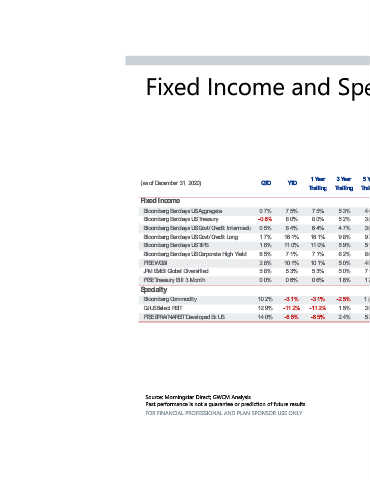

Fixed Income and Specialty Returns

5 Y ear 10 Y ear 2014 2015 2016 2017 2018 2019 2020 railing T Trailing 6.0% 0.5% 2.6% 3.5% 0.0% 8.7% 7.5% 3.8% 4.4% 5.1% 0.8% 1.0% 2.3% 0.9% 6.9% 8.0% 3.3% 3.8% 3.1% 1.1% 2.1% 2.1% 0.9% 6.8% 6.4% 3.1% 3.6% 19.3% -3.3% 6.7% 10.7% -4.7% 19.6% 16.1% 8.2% 9.3% 3.6% -1.4% 4.7% 3.0% -1.3% 8.4% 11.0% 3.8% 5.1% 2.5% -4.5% 17.1% 7.5% -2.1% 14.3% 7.1% 6.8% 8.6% -0.5% -3.6% 1.6% 7.5% -0.8% 5.9% 10.1% 2.3% 4.8% 7.4% 1.2% 10.2% 10.3% -4.3% 15.0% 5.3% 6.2% 7.1% % 0 . 0 % 0 . 0 % 3 0. 0.8% 1.9% 2.3% 0.6% 0.6% 1.2% -17.0% -24.7% 11.8% 1.7% -11.2% 7.7% -3.1% -6.5% 1.0% 32.0% 4.5% 6.7% 3.8% -4.2% 23.1% -11.2% 7.6% 3.0% 3.2% -3.2% 2.0% 20.8% -5.8% 21.8% -6.5% 5.1% 5.

ear Trailing 5.3% 5.2% 4.7% 9.8% 5.9% 6.2% 5.0% 5.0% 1.6% -2.5% 1.5% 2.4%

3 Y

ear railing 7.5% 8.0% 6.4% 16.1% 11.0% 7.1% 10.1% 5.3% 0.6% -3.1% -11.2% -6.5%

1 Y T

D

T 7.5% 8.0% 6.4% 16.1% 11.0% 7.1% 10.1% 5.3% 0.6% -3.1% -11.2% -6.5%

Y

D

QT 0.7% -0.8% 0.5% 1.7% 1.6% 6.5% 2.8% 5.8% 0.0% 10.2% 12.9% 14.0%

ovt/Cedit Intermedia ong orporate High Yeld i S Past performance is not a guarantee or prediction of future results. FOR FINANCIAL PROFESSIONAL AND PLAN SPONSOR USE ONLY.

ggregate SA reasury ST r G S ovt/Cedit L r G S S STP I C S x U eveloped E Source: Morningstar Direct; GWCM Analysis

ecember 31, 2020) me arclays U arclays U arclays U arclays U arclays U arclays U BI I Gobal Dversified i l reasury Bill 3 Month ommodity ET I elect R ETD I /NAR A

(as of D Inco ed Fix loomberg B B loomberg B B loomberg B B loomberg B B loomberg B B loomberg B B G EW S FT MB M E JP ET S FT ialty ec p S loomberg C B S S DJU PR E E S FT