Page 34 - MayDefComp

P. 34

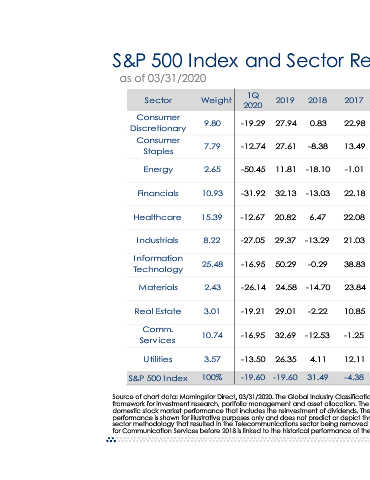

S&P 500 Index and Sector Returns (%)

2017 2010 2011 2012 2013 2014 2015 2016 27.66 6.13 23.92 43.08 9.68 10.11 6.03 22.98 14.11 13.99 10.76 26.14 15.98 6.60 5.38 13.49 20.46 4.72 4.61 25.07 -7.78 -21.12 27.36 -1.01 12.13 -17.06 28.82 35.63 15.20 -1.53 22.80 22.18 2.90 12.73 17.89 41.46 25.34 6.89 -2.69 22.08 26.73 -0.59 15.35 40.68 9.83 -2.53 18.86 21.03 10.19 2.41 14.82 28.43 20.12 5.92 13.85 38.83 22.20 -9.75 14.97 25.60 6.91 -8.38 16.69 23.84 32.32 11.39 19.74 1.60 30.19 4.68 3.39 10.85 18.97 6.27 18.31 11.47 2.99 3.40 23.49 -1.25 5.46

2018 0.83 -8.38 -18.10 -13.03 6.47 -13.29 -0.29 -14.70 -2.22 -12.53 4.11 31.49 framework for investment research, portfolio management and asset allocation. The GICS structure consists of 10 sectors. The S&P domestic stock market performance that includes the reinvestment of dividends. The index is unmanaged and cannot be purchased performance is shown for illustrative purposes only and does not predict or depict the performance of any particular investment.

2019 27.94 27.61 11.81 32.13 20.82 29.37 50.29 24.58 29.01 32.69 26.35 -19.60

1Q 2020 -19.29 -12.74 -50.45 -31.92 -12.67 -27.05 -16.95 -26.14 -19.21 -16.95 -13.50 -19.60

Weight 9.80 7.79 2.65 10.93 15.39 8.22 25.48 2.43 3.01 10.74 3.57 100%

as of 03/31/2020 Sector Consumer Discretionary Consumer Staples Energy Financials Healthcare Industrials Information Technology Materials Real Estate Comm. Services Utilities S&P 500 Index