Page 143 - NovDefComp

P. 143

Scorecard - HRA Plan

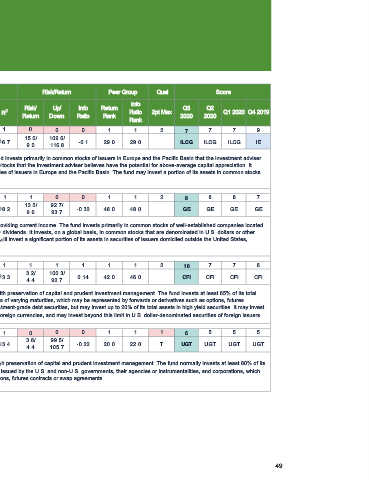

Style Risk/Return Peer Group Qual Score

Asset Ticker/

Active Assets Info

Class I D Style Risk/ Up/ Info Return Q3 Q2

Style R 2 Ratio 2pt Max Q1 2020 Q4 2019

Drift Return Down Ratio Rank 2020 2020

Rank

1 1 1 0 0 0 1 1 2 7 7 7 9

American Funds

$0.00 ILCG FEUPX 40.1/ 15.0/ 109.6/

Europacific Growth F3 10.6 86.7 -0.1 29.0 29.0 ILCG ILCG ILCG IE

16.2 9.0 116.8

The investment seeks long-term growth of capital. The fund invests primarily in common stocks of issuers in Europe and the Pacific Basin that the investment adviser

believes have the potential for growth. Growth stocks are stocks that the investment adviser believes have the potential for above-average capital appreciation. It

Strategy Review

normally will invest at least 80% of its net assets in securities of issuers in Europe and the Pacific Basin. The fund may invest a portion of its assets in common stocks

and other securities of companies in emerging markets.

1 1 1 1 0 0 1 1 2 8 8 8 7

American Funds Capital

$0.00 GE FWGIX 6.0/ 13.5/ 92.7/

World Gr&Inc F3 16.4 98.2 -0.32 46.0 48.0 GE GE GE GE

54.0 9.6 93.7

The investment seeks long-term growth of capital while providing current income. The fund invests primarily in common stocks of well-established companies located

around the world, many of which have the potential to pay dividends. It invests, on a global basis, in common stocks that are denominated in U.S. dollars or other

Strategy Review

currencies. Under normal market circumstances, the fund will invest a significant portion of its assets in securities of issuers domiciled outside the United States,

including those based in developing countries.

1 1 1 1 1 1 1 1 2 10 7 7 6

PIMCO Total Return A $8,990.91 CFI PTTAX 20.5/ 3.2/ 100.3/

15.1 83.3 0.14 42.0 46.0 CFI CFI CFI CFI

63.1 4.4 92.7

The investment seeks maximum total return, consistent with preservation of capital and prudent investment management. The fund invests at least 65% of its total

assets in a diversified portfolio of Fixed Income Instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures

Strategy Review

contracts, or swap agreements. It invests primarily in investment-grade debt securities, but may invest up to 20% of its total assets in high yield securities. It may invest

up to 30% of its total assets in securities denominated in foreign currencies, and may invest beyond this limit in U.S. dollar-denominated securities of foreign issuers.

1 1 1 0 0 0 1 1 1 6 5 5 5

PIMCO Real Return A $4,915.55 UGT PRTNX -83.4/ 3.8/ 99.5/

2.1 93.4 -0.22 20.0 22.0 T UGT UGT UGT UGT

83.3 4.4 105.7

The investment seeks maximum real return, consistent with preservation of capital and prudent investment management. The fund normally invests at least 80% of its

Strategy Review net assets in inflation-indexed bonds of varying maturities issued by the U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations, which

may be represented by forwards or derivatives such as options, futures contracts or swap agreements.

49